Expert Review

-

Swiftnaira

They'll shoot off SMS to your contacts, saying you owe them money.

Brace yourself for a barrage of nasty WhatsApp messages if you're just a day late.

Their repayment plans usually last between 6 to 14 days, making it a real struggle to pay up.

Expect overdue interest rates of 5% to 7% per day, pushing you deeper into debt.

Don't bother paying them back once they tarnish your name. They've already got what they wanted.

Since they're not licensed, they can't take legal action against you. Their only weapon is to smear your reputation.

Avoid borrowing from other loan apps to settle your debts; you'll only dig yourself into a deeper hole.

Use Truecaller to screen and block their calls, sparing yourself unnecessary stress.

The best way to break free from loan sharks is to stop borrowing altogether.

Block them on WhatsApp and report them directly to WhatsApp and Google Play Store to protect others from falling into the same trap.

-

Credit moi

We will review the apps within the next 48 hours and provide detailed information and also do our background checks10 Commandments for Dealing with Loan Sharks

1. Ignore Harassing Messages: If loan sharks have already contacted your friends or family, don't worry. You don't owe them anything more. Move forward and focus on your life.

2. Unlicensed Apps Are Helpless: Loan apps resorting to defamation aren't legitimate. They can't legally harm you. Their only tool is to shame you.

3 Your Contacts Can't Save You: Most of your contacts won't be able to assist you, and they're likely aware of the shady tactics loan sharks use.

4 Beware of Short-Term Loans: Loans with short durations and high interest rates often lead to threats and defamation. Avoid loan sharks. If you must borrow, choose licensed lenders.

5 Debt Leads to Bankruptcy: Borrowing from these apps can wreck your finances and push you towards bankruptcy. The best solution is to stop borrowing altogether.

6 Avoid Overdue Interest: If you've already paid back the principal and initial interest, ignore any demands for overdue interest.

7 Don't Cycle Debts: Taking a loan to pay off another leads to a cycle of debt. Loan sharks have multiple apps, and you'll end up deeper in trouble

8 Use Truecaller to Block: Install Truecaller on your phone to identify loan shark calls and block them. Also, report them on WhatsApp and Google Play Store.

9 Break Free from Loan Sharks: The only way to escape loan sharks is to stop borrowing from them. You survived before they came into your life. Don't let them tarnish your reputation.

10 Stay strong, and prioritize your financial well-being: Remember, health is wealth. Do not allow loan sharks to jeopardize your future!.

-

Cash bus

Let me give you the lowdown on Cash bus:

They'll shoot off SMS to your contacts, saying you owe them money.

Brace yourself for a barrage of nasty WhatsApp messages if you're just a day late.

Their repayment plans usually last between 6 to 14 days, making it a real struggle to pay up.

Expect overdue interest rates of 5% to 7% per day, pushing you deeper into debt.

Don't bother paying them back once they tarnish your name. They've already got what they wanted.

Since they're not licensed, they can't take legal action against you. Their only weapon is to smear your reputation.

Avoid borrowing from other loan apps to settle your debts; you'll only dig yourself into a deeper hole.

Use Truecaller to screen and block their calls, sparing yourself unnecessary stress.

The best way to break free from loan sharks is to stop borrowing altogether.

Block them on WhatsApp and report them directly to WhatsApp and Google Play Store to protect others from falling into the same trap.

-

Cash farm

Here's the lowdown on Shady Sharps like Nairabus:

- They spread rumors like wildfire: If you miss a payment, they might tell your friends and family you owe them money. Talk about embarrassing!

- They get mean real quick: Forget friendly reminders. Shady Sharps love bombarding you with nasty messages on WhatsApp the moment you're even a day late. Not cool, right?

- Time pressure is their game: They often give you super short deadlines to repay, like 6 to 14 days. Feeling the heat? This makes it hard to catch up, and boom, you're stuck in debt.

- Interest rates that bite: Imagine getting charged extra every single day you're late. Yikes! That small loan can snowball into a HUGE problem in no time.

- Don't be fooled by their bluff: Remember, Shady Sharps are often unlicensed. Their main weapon is shaming you, not taking you to court. So, don't give in to their threats – they already got their payback by hurting your reputation.

- They're like a sneaky chameleon: They have tons of different apps under different names. Trying to pay one Shady Sharp with another is a terrible idea. It's like playing whack-a-mole, but you always lose!

- Silence is your shield: Don't reply to their messages or pick up their calls. Block them on WhatsApp and report them directly to the platform and app store. Fight back by ignoring their drama!

- Break free for good: The only way to escape Shady Sharps is to stop borrowing from them. It might seem tough, but you've got this! Remember, you survived before they came along. Trust yourself to find other ways to make ends meet. Don't let them control your life!

Here are some extra tips to help you stay safe:

- Install Truecaller: This app can help you identify their calls and block their numbers. ️

- Seek help if needed: Talk to a trusted friend, family member, or financial advisor if you're struggling with debt. There are people who want to help!

Remember, there's always another way. Stay strong, stay informed, and don't let Shady Sharps like Nairabus control your life! You've got this!

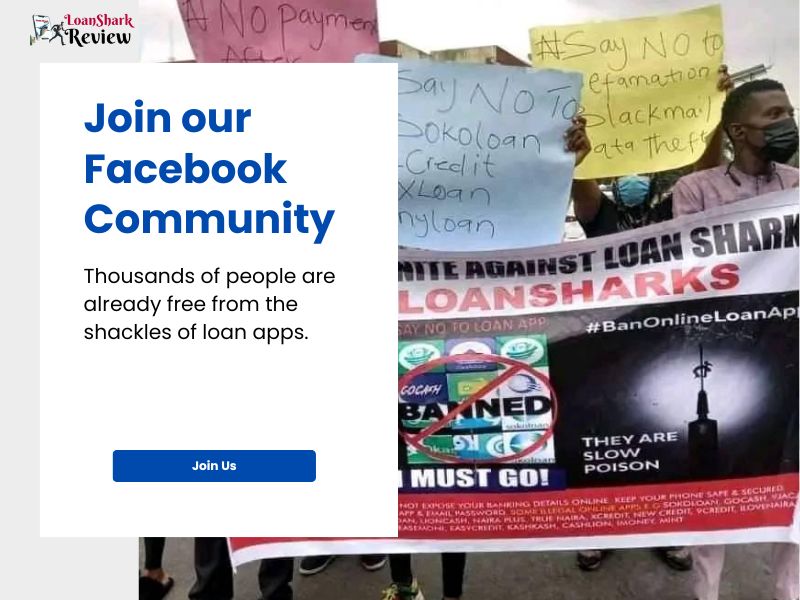

Join our Facebook Group

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.