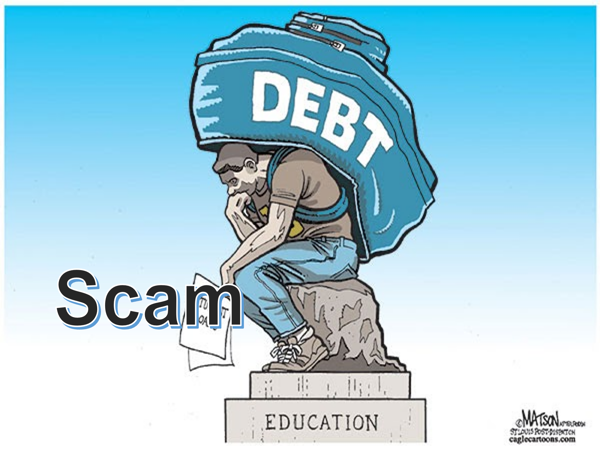

It all started when Kemi’s car broke down on her way to work. The repair costs were much higher than she had expected, and she didn’t have enough savings to cover the bill. After weighing her options, she decided to apply for a personal loan. However, little did she know that her desperation would lead her into the hands of scammers.

Kemi's story is a common one. In a rush to find a quick loan, many people overlook the warning signs of loan scams and end up in more financial trouble. Here's how you can avoid falling victim, just like Kemi learned too late.

Step 1: Never Download Apps Outside the Play Store or App Store

When Kemi began her search for a loan, she stumbled upon a website that seemed legitimate. It promised instant approval for loans, with no credit check required. Excited by the quick solution, Kemi clicked on a link that directed her to download an app directly from the website.

She soon discovered the app was not available on trusted platforms like the Play Store or App Store, but she thought nothing of it at the time. Within days of downloading the app, Kemi started receiving harassing calls demanding immediate payment, even though she hadn't received the loan. To make matters worse, her personal information was compromised.

Lesson: Always download loan apps from trusted platforms like the Play Store or App Store. Scammers often create fake loan apps that harvest your personal information or harass you with outrageous fees and interest rates. If an app isn’t listed on these trusted stores, it’s a huge red flag.

Step 2: Check LoanSharkReview for Reliable Reviews

A friend introduced Kemi to the LoanSharkReview website after hearing about her troubles. She realized that if she had checked it earlier, she could have avoided the scam entirely.

LoanSharkReview is a trusted platform that evaluates loan apps and lending institutions, providing honest feedback on their legitimacy, interest rates, and customer service. It also highlights dangerous apps, like those that make misleading promises or fail to disclose their outrageous fees.

Lesson: Before you apply for any loan, especially from an app, check reviews on trusted sites like LoanSharkReview. This will help you avoid predatory lenders and ensure you're borrowing from a legitimate source.

Step 3: Never Download Loan Apps Through a Link

Kemi’s first mistake was clicking a random link. Scammers often use phishing tactics, sending you direct links through emails, social media ads, or even messages to trick you into downloading malicious apps. These apps can steal your personal data, hack your phone, or force you into agreeing to absurd loan terms.

When you receive such links, always be cautious. Legitimate loan companies will guide you through proper channels, such as downloading their app from the Play Store or App Store or visiting their secure websites.

Lesson: Never download apps through links sent via messages, emails, or unknown websites. Go directly to the Play Store or App Store to verify the app's legitimacy.

Step 4: Avoid 7-Day Loan Apps—They Will Ruin Your Finances

In Kemi's case, she found a loan app that promised quick approval for a small amount of N20,000, repayable within 7 days. The interest rates seemed manageable, and she thought it would be a fast fix for her car repairs.

However, she soon realized the app was a 7-day loan app, notorious for devastating people’s finances. Not only did Kemi owe more than she expected due to hidden fees, but the app began harassing her for repayment just three days after receiving the loan. The high fees, combined with the short repayment period, forced her to borrow again just to cover the previous loan—trapping her in a vicious cycle of debt.

Lesson: Avoid 7-day loan apps at all costs. While they may promise quick cash, the short repayment terms and high fees will leave you worse off than when you started. These apps are designed to push you into taking out more loans, drowning you in debt.

Step 5: Read Reviews Outside the Play Store and App Store

After her ordeal, Kemi learned that many reviews on the Play Store or App Store are often paid for by the loan companies themselves. These reviews give an illusion of legitimacy but hide the dark side of these loan apps. While an app might have a high rating, it's essential to look for reviews on independent platforms.

By reading outside reviews, like those on LoanSharkReview or other financial forums, Kemi discovered the truth about her lender: they were a predatory loan service with a track record of harassing borrowers and charging exorbitant fees.

Lesson: Don’t rely solely on the reviews you see on the Play Store or App Store. These can often be manipulated. Instead, look for independent reviews from trustworthy sources outside of these platforms, such as LoanSharkReview or other reputable financial websites.

How to Protect Yourself from Loan Scams

To sum up, here’s a step-by-step guide on how to avoid loan scams when applying for a personal loan:

Always download loan apps from trusted platforms like the Play Store or App Store. If the app is not available on these platforms, it’s likely a scam.

Check LoanSharkReview for honest feedback and reviews before choosing a loan provider. The site offers in-depth analysis and warnings about predatory lenders.

Never click on links sent through email or social media to download a loan app. Go directly to official app stores to ensure the app is legitimate.

Avoid 7-day loan apps, as they typically offer short repayment periods with high fees, trapping you in a cycle of debt.

Read reviews from independent sources outside of the Play Store and App Store. These reviews offer a more accurate picture of the app’s services.

Kemi’s story is a wake-up call for anyone considering a personal loan through an app. The financial world is filled with scams designed to take advantage of your desperation. But by following these steps, you can protect yourself from loan scams and make smarter financial decisions.

If you ever feel uncertain, remember to consult trusted resources like LoanSharkReview to keep yourself safe.

.jpg)