Expert Review

-

Lilycash

Navigating Repayment Issues with Lilycash: What You Should Know

When using the Lilycash app, it’s essential to be aware of certain repayment aspects. Here’s a guide to help you navigate potential challenges:

Unregistered Status

Lilycash operates without proper registration, which means it may not adhere to the legal guidelines and regulations established by financial authorities.

Inappropriate Communication

If Lilycash has sent disrespectful or offensive messages to your contacts, know that such behavior can be damaging and embarrassing. However, the situation has already occurred, and they have received their funds through these actions. You are not obligated to repay them; if they demand payment, inform them that you are prepared to address the matter in court.

Reputation Damage

If Lilycash has harmed your reputation by sending derogatory messages, repaying them may not rectify the damage done. Once your reputation is tarnished, paying them back may offer little benefit.

Utilize TrueCaller

To help manage unwanted communication, consider installing TrueCaller. This app is effective for identifying and blocking spam calls, allowing you to filter out unwanted contact from Lilycash.

Prevent Automatic Withdrawals

To stop Lilycash from automatically debiting your bank account, it's essential to block your bank card. Visit your bank to request a new card to prevent unauthorized transactions.

Block on Messaging Platforms

You can block Lilycash's contact on platforms like WhatsApp to halt any incoming messages. Additionally, report them to WhatsApp to notify the platform of their inappropriate behavior.

Report to App Stores

If Lilycash is listed on Google Play Store or the Apple App Store, take the initiative to report the app. This action helps warn other users about their practices and may lead to the app being removed from the store.

Conclusion

Taking these steps is crucial in protecting yourself from further harassment and ensuring your peace of mind when dealing with Lilycash. Stay informed and safeguard your interests.

-

-

-

-

BGLOAN app

Let's explore BGloan's practices and how to navigate them effectively.

It's important to be aware that BGloan employs certain tactics that can be distressing. One notable approach is their tendency to send SMS messages to your contacts, informing them about your outstanding debt. Furthermore, once your payment becomes overdue—often just one day past the due date—they begin sending derogatory messages via WhatsApp to your contacts.

BGloan typically offers repayment plans that range from 6 to 14 days, which can be difficult to manage. Their overdue interest rates also escalate quickly, ranging from 2% to 7% per day, which can further strain your financial situation.

It's crucial to resist the temptation to make payments when BGloan resorts to these defamation tactics. Paying them under these circumstances only reinforces their methods and allows them to profit from damaging your reputation.

It’s important to note that BGloan operates as an unlicensed loan app, which limits their recourse primarily to intimidation tactics. Borrowing from another loan app to pay them off only perpetuates the cycle of debt, as many of these apps are available on mobile platforms.

To reduce their impact, consider using Truecaller on your mobile device to identify and block their calls and messages. Additionally, blocking them on WhatsApp and reporting their behavior directly on platforms like WhatsApp and the Google Play Store can serve as proactive measures.

Ultimately, the most effective way to escape the clutches of loan sharks like BGloan is to stop borrowing from them altogether. Remember, your integrity and financial well-being are paramount, and there are alternative sources of support that can help you navigate your financial challenges without resorting to their services.

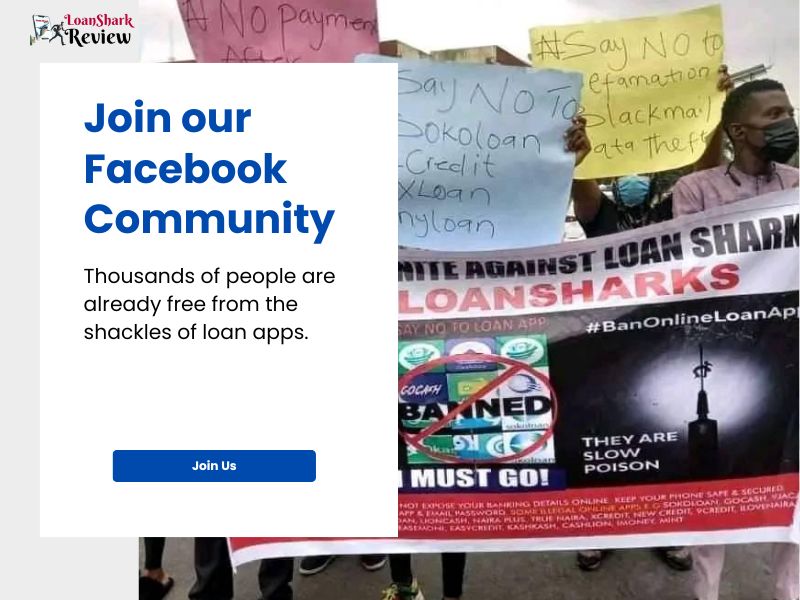

Join our Facebook Group

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.