Expert Review

-

KKcash

Allow me to shed some light on KK Cash and what you need to know to safeguard your financial well-being.

To begin with, KK Cash has a rather aggressive approach when it comes to debt collection. They won't hesitate to bombard every single one of your contacts with automated calls, making sure everyone knows about your outstanding debt. And if that's not enough, they'll also flood your WhatsApp with derogatory messages if you're just one day overdue. It's not a pleasant experience, to say the least.

Now, let's talk about their repayment plans. KK Cash typically offers repayment periods ranging from 6 days to 14 days, which can be quite challenging to meet. And to make matters worse, their overdue interest rates can soar as high as 5% to 7% per day, pushing you further into the abyss of debt.

Here's a crucial piece of advice: once KK Cash starts defaming you, don't even think about paying them back. They've already gotten what they wanted, and paying them won't make the derogatory messages disappear. Plus, since they're not licensed, they don't have much legal recourse besides tarnishing your reputation.

Whatever you do, resist the temptation to borrow from another loan app to repay KK Cash. They have a plethora of apps scattered across mobile app stores, so if you think you're escaping one debt by borrowing from another, think again. You'll only find yourself sinking deeper into financial trouble.

To shield yourself from KK Cash relentless harassment, consider installing Truecaller on your mobile phone. This handy app can help you identify and block their calls, giving you some much-needed peace of mind.

Ultimately, the best way to break free from KK Cash clutches is to stop borrowing altogether. It might not be easy, but it's the only way to avoid getting caught in their web of debt.

Take care, and remember that your financial well-being is worth more than any loan. Stay vigilant, make wise borrowing decisions, and don't let KK Cash or any other loan shark drag you down.

-

9Credit loan-Instant loan Cash

Let me give you the lowdown on 9Credit Instant Loan App. Here's what you need to know:

- Contact Messages: These folks might start sending SMS to your contacts saying you owe them money.

- WhatsApp Woes: Brace yourself for all sorts of rude messages on WhatsApp if you're even a day late on payment.

- Short Repayment Window: You'll usually get stuck with a 6 to 14-day repayment plan, making it tough to cough up the cash.

- High Overdue Interest: Watch out for sky-high overdue interest rates, ranging from 1% to a whopping 5% per day, piling up debt faster than you can blink.

- Defamation Dilemma: Once they start badmouthing you, don't bother paying up. They've already got what they wanted.

- Unlicensed Trouble: These apps aren't legit. They can't do much except tarnish your name.

- No Borrowing from Borrowers: Steer clear of borrowing from one loan app to pay another. It's a recipe for financial disaster.

- Truecaller Tip: Install Truecaller to dodge their calls and block their contacts, keeping them at bay.

- Breaking Free: The only real way to escape their clutches is to stop borrowing altogether.

- Report and Block: Shut them out by blocking them on WhatsApp and reporting them directly on WhatsApp and Google Play Store.

- Regain Your Freedom: Remember, you were doing just fine before they showed up. Don't let them mess with your integrity.

-

Pasa

They'll shoot off SMS to your contacts, saying you owe them money.

Brace yourself for a barrage of nasty WhatsApp messages if you're just a day late.

Their repayment plans usually last between 6 to 14 days, making it a real struggle to pay up.

Expect overdue interest rates of 5% to 7% per day, pushing you deeper into debt.

Don't bother paying them back once they tarnish your name. They've already got what they wanted.

Since they're not licensed, they can't take legal action against you. Their only weapon is to smear your reputation.

Avoid borrowing from other loan apps to settle your debts; you'll only dig yourself into a deeper hole.

Use Truecaller to screen and block their calls, sparing yourself unnecessary stress.

The best way to break free from loan sharks is to stop borrowing altogether.

Block them on WhatsApp and report them directly to WhatsApp and Google Play Store to protect others from falling into the same trap.

-

Palm Credit

PalmCredit is a reputable lending platform committed to delivering valuable financial assistance while prioritizing borrower satisfaction. Here are key considerations to keep in mind when interacting with PalmCredit:

1. Respectful Repayment Practices

PalmCredit maintains a respectful and supportive approach toward repayments. If borrowers choose to repay gradually, the platform does not engage in defamatory or harmful practices. This allows you to manage your repayments at your own pace without the fear of negative consequences or reputational damage.

2. Interest Payment Guidelines

PalmCredit advises borrowers to pay only the regular interest and principal amount when clearing their loans. You are not required to pay overdue interest after settling the initial loan terms. Following this guideline helps prevent unnecessary financial pressure and ensures a smoother repayment experience.

3. Managing Communication

If you experience persistent calls or WhatsApp messages from PalmCredit after the loan period, it's recommended that you block their contact numbers. After 30 days, you should stop receiving further communications. This proactive step allows you to maintain peace of mind and avoid unnecessary distractions during your financial recovery.

4. Avoid Borrowing to Repay

It’s strongly discouraged to borrow from other loan apps to repay PalmCredit loans. Engaging in such practices could lead to a dangerous cycle of debt and financial instability, making it harder to regain financial balance. Focus on managing repayments within your own means to avoid compounding challenges.

5. Use Truecaller for Blocking Unwanted Calls

To minimize unwanted calls from lenders like PalmCredit, you can install Truecaller on your mobile device. This app helps identify and block spam calls, giving you control over your communication and helping prevent disruptions from loan service providers.

By following these guidelines and taking advantage of PalmCredit's borrower-friendly policies, you can effectively manage your loan repayments and maintain a healthy financial relationship with the platform.

-

Moneytree mycash

- Be cautious if you receive SMS messages from lenders claiming you owe them money—they may send these to your contacts as well.

- Expect a barrage of unpleasant WhatsApp messages if your repayment is even just one day late.

- Many of these lenders impose short repayment schedules, typically ranging from 6 to 14 days, making it extremely difficult to manage your debts.

- Prepare for daily overdue interest rates between 5% and 7%, which can quickly lead you deeper into financial trouble.

- Once your reputation is damaged, their goal is achieved, and they may no longer expect repayment.

- Without a proper license, these lenders cannot take legal action against you; their primary strategy is to harm your reputation.

- Avoid the trap of borrowing from other loan apps to pay off existing debts, as this can only complicate your situation further.

- Use Truecaller to screen and block calls from these lenders, reducing your stress and anxiety.

- The best way to escape the clutches of loan sharks is to stop borrowing altogether.

- Don’t hesitate to block them on WhatsApp and report them to both WhatsApp and the Google Play Store to protect yourself and others from falling victim to their schemes.

Stay informed and make wise financial choices to protect yourself from predatory lending practices.

-

Yoyi loan app

- They will send SMS notifications to your contacts, falsely claiming that you owe them money.

- Brace yourself for a flood of threatening WhatsApp messages if you miss even a single day of repayment.

- Their repayment periods usually span 6 to 14 days, making it extremely difficult to clear your debt.

- Expect daily overdue interest rates between 5% and 7%, pushing you deeper into financial strain.

- Once they’ve damaged your reputation, there's no point in paying them back. Their primary goal has already been met.

- Operating without a license, they cannot take legal action. Their only strategy is to ruin your reputation.

- Avoid borrowing from other loan apps to settle your debts; it will only trap you further.

- Use Truecaller to block their calls and avoid unnecessary stress.

- The best way to escape loan sharks is by stopping the cycle of borrowing entirely.

- Block them on WhatsApp and report the app to WhatsApp and Google Play Store to protect others from falling into the same trap.

-

Cashtree

- They will send SMS messages to your contacts, claiming that you owe them money.

- Prepare yourself for an onslaught of unpleasant WhatsApp messages if you are even a day late.

- Their repayment schedules typically range from 6 to 14 days, making it extremely challenging to settle your debts.

- Anticipate daily overdue interest rates ranging from 5% to 7%, pushing you further into debt.

- Once they tarnish your reputation, there is no need to repay them. They have already achieved their goal.

- Since they lack a license, they are unable to pursue legal action against you. Their sole tactic is to damage your reputation.

- Avoid borrowing from other loan apps to clear your debts; this will only worsen your situation.

- Utilize Truecaller to screen and block their calls, sparing yourself unnecessary stress.

- The most effective way to break free from loan sharks is to cease borrowing altogether.

- Block them on WhatsApp and report them directly to WhatsApp and Google Play Store to prevent others from falling victim to the same scheme.

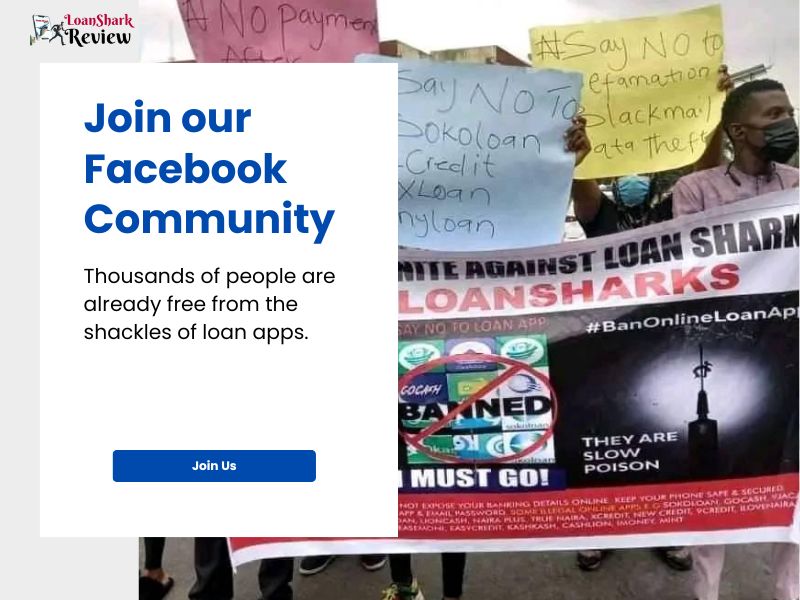

Join our Facebook Group

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.