Expert Review

-

Ease Cash

Let's discuss the Ease Cash lending service and its implications for borrowers. Firstly, it's important to note that this lending platform operates differently from traditional financial institutions. Here are some key points to consider:

Ease Cash may resort to contacting your acquaintances via SMS if you have outstanding debt with them.

In the event of even a one-day delay in repayment, Ease Cash might send disparaging messages to your WhatsApp contacts.

Their repayment plans typically range from 6 to 14 days, which can pose challenges for borrowers.

Overdue interest rates fluctuate between 2% and 7% per day, potentially leading to a cycle of increasing debt.

Refraining from repayment won't deter Ease Cash; instead, they may resort to defaming tactics to retrieve their funds.

These loan apps lack proper licensing, limiting their recourse to defamatory actions as their primary means of enforcement.

Borrowing from another loan app to settle debts with Ease Cash can exacerbate financial troubles, potentially leading to bankruptcy.

Truecaller can help identify and block unwanted calls from Ease Cash and similar entities.

Ultimately, the most effective way to break free from the grip of loan sharks like Ease Cash is to cease borrowing altogether.

Blocking their communication channels on WhatsApp and reporting their activities on platforms like WhatsApp and Google Play Store can help mitigate their influence.

Remember, your integrity and financial well-being are paramount; avoiding further borrowing is crucial to reclaiming control over your finances.

-

LCredit

Allow me to shed some light on LCredit and what you need to know to safeguard your financial well-being.

To begin with, LCredit has a rather aggressive approach when it comes to debt collection. They won't hesitate to bombard every single one of your contacts with automated calls, making sure everyone knows about your outstanding debt. And if that's not enough, they'll also flood your WhatsApp with derogatory messages if you're just one day overdue. It's not a pleasant experience, to say the least.

Now, let's talk about their repayment plans. LCredit typically offers repayment periods ranging from 6 days to 14 days, which can be quite challenging to meet. And to make matters worse, their overdue interest rates can soar as high as 5% to 7% per day, pushing you further into the abyss of debt.

Here's a crucial piece of advice: once LCredit starts defaming you, don't even think about paying them back. They've already gotten what they wanted, and paying them won't make the derogatory messages disappear. Plus, since they're not licensed, they don't have much legal recourse besides tarnishing your reputation.

Whatever you do, resist the temptation to borrow from another loan app to repay LCredit. They have a plethora of apps scattered across mobile app stores, so if you think you're escaping one debt by borrowing from another, think again. You'll only find yourself sinking deeper into financial trouble.

To shield yourself from LCredit's relentless harassment, consider installing Truecaller on your mobile phone. This handy app can help you identify and block their calls, giving you some much-needed peace of mind.

Ultimately, the best way to break free from LCredit's clutches is to stop borrowing altogether. It might not be easy, but it's the only way to avoid getting caught in their web of debt.

Take care, and remember that your financial well-being is worth more than any loan. Stay vigilant, make wise borrowing decisions, and don't let LCredit or any other loan shark drag you down.

-

Flexi Cash

Here's what you should know:

1. They won't hesitate to send SMS to your contacts, letting them know you owe them some cash.

2. Brace yourself for a flood of not-so-nice messages on WhatsApp if you're just a day overdue.

3. Their repayment plans usually span from 6 to 14 days, which can be pretty tough to manage.

4. Watch out for their steep overdue interest rates, ranging from 1% to a hefty 5% per day. That'll just land you in deeper debt.

5. Don't give in and pay up if they start smearing your name. Remember, they've got their cash when they've defamed you.

6. Despite being unlicensed, their go-to move is to defame you. Pretty low, right?

7. Whatever you do, don't try borrowing from another loan app to settle your debts with them. It's a recipe for financial disaster.

8. Consider installing Truecaller on your phone to screen their calls and block them altogether.

9. The best way to shake off these loan sharks? Stop borrowing altogether.

10. If they're causing trouble, don't hesitate to block them on WhatsApp and report their shady practices straight to WhatsApp and the Google Play Store.

11. Remember, you were doing just fine before they showed up. Don't let them tarnish your reputation or your wallet.

-

Galaxy Credit

- They gossip like nobody's business: If you miss a payment, they might blab to your contacts that you owe them money. Yikes! Talk about public embarrassment.

- They turn nasty fast: Forget polite reminders. Shady Sams love spamming your WhatsApp with harsh messages the moment you're even a day late. Not cool, right?

- The clock's ticking: They often give you super short deadlines to repay, like 6 to 14 days. Pressure much? This makes it hard to catch up, pushing you deeper into debt.

- Interest rates bite: Imagine getting charged 2% to 7% extra every single day you're late. Yikes! That adds up quickly, turning a small loan into a huge burden.

- Blackmail alert: Remember, Shady Sams are often unlicensed. Their main weapon is shaming you, not legal action. So, don't give in to their threats – they already got their "pound of flesh" by hurting your reputation.

- They're like a hydra: They have tons of apps under different names. Trying to pay one with another Shady Sam loan is a terrible idea. It's like fighting one head of a monster only to have two more pop up!

- Silence is golden: Don't reply to their messages or calls. Block them on WhatsApp and report them directly to the platform and app store. Fight back by ignoring their drama!

- Break free! The only way to escape Shady Sams is to stop borrowing from them. It might seem tough, but you've got this! Remember, you survived before they came along. Trust yourself to find other ways to make ends meet. Don't let them bully you or break your spirit.

Remember, there's always another way. Install Truecaller to screen their calls and block their numbers. Stay strong, and don't let Shady Sams control your life! You've got this!

-

Kk Cash

Allow me to shed some light on KK Cash and what you need to know to safeguard your financial well-being.

To begin with, KK Cash has a rather aggressive approach when it comes to debt collection. They won't hesitate to bombard every single one of your contacts with automated calls, making sure everyone knows about your outstanding debt. And if that's not enough, they'll also flood your WhatsApp with derogatory messages if you're just one day overdue. It's not a pleasant experience, to say the least.

Now, let's talk about their repayment plans. KK Cash typically offers repayment periods ranging from 6 days to 14 days, which can be quite challenging to meet. And to make matters worse, their overdue interest rates can soar as high as 5% to 7% per day, pushing you further into the abyss of debt.

Here's a crucial piece of advice: once KK Cash starts defaming you, don't even think about paying them back. They've already gotten what they wanted, and paying them won't make the derogatory messages disappear. Plus, since they're not licensed, they don't have much legal recourse besides tarnishing your reputation.

Whatever you do, resist the temptation to borrow from another loan app to repay KK Cash. They have a plethora of apps scattered across mobile app stores, so if you think you're escaping one debt by borrowing from another, think again. You'll only find yourself sinking deeper into financial trouble.

To shield yourself from KK Cash relentless harassment, consider installing Truecaller on your mobile phone. This handy app can help you identify and block their calls, giving you some much-needed peace of mind.

Ultimately, the best way to break free from KK Cash clutches is to stop borrowing altogether. It might not be easy, but it's the only way to avoid getting caught in their web of debt.

Take care, and remember that your financial well-being is worth more than any loan. Stay vigilant, make wise borrowing decisions, and don't let KK Cash or any other loan shark drag you down.

-

Oxloan Pro

Oxloan Pro? Hold on tight! Before you click "apply," let's chat about some red flags you should know:

Public Shaming? Not Cool: Forget the drama! Oxloan Pro might blast your contacts with messages saying you owe them money. Imagine your phone blowing up with embarrassing texts – not the best look, right?

WhatsApp Woes: Brace yourself for a barrage of harsh messages on WhatsApp if you're even a day late. Think of it like a digital scolding – not exactly helpful or respectful.

Short Deadline Trap: Their repayment plans are often super short (6-14 days!), making it tough to catch up. Don't get caught in their tightrope act!

Interest Spiral: Watch out for sky-high daily interest rates (1-5%) that can snowball your debt faster than you can say "ouch!" It's like a debt avalanche waiting to happen.

Don't Feed the Defamation: Remember, shaming you is their tactic, not their right. If they defame you, don't pay them a dime! They already have their "money" – your dignity.

Unlicensed Loan Sharks: These apps operate outside the law, so their threats are mostly empty. Their main weapon is shame, but you don't have to play their game.

Debt Trap Trap: Borrowing from another app to pay them is like jumping from one frying pan into another fire. They have multiple apps, so you might end up deeper in debt with them again.

Silence the Buzz: Feeling harassed? Download Truecaller to identify and block their calls. You deserve peace of mind to focus on finding solutions.

Break Free From the Cycle: The real key to escaping loan sharks is to stop borrowing altogether. They might seem like your only option, but they're not! Explore other ways to manage your finances, like budgeting or seeking help from trusted organizations.

Report & Block: Don't let them win! Report them to WhatsApp and Google Play Store. Block them on your phone and cut off all contact.

Live Beyond Loans: You existed before them, and you can thrive after them. Don't let them control your life or damage your reputation. Remember, your integrity is worth more than any loan.

Remember, you're not alone. There are resources and support available to help you manage your finances and break free from the debt cycle. Don't let loan sharks like Oxloan Pro control you. Take a stand, be informed, and find a healthier path forward.

-

LinkCredit

It might seem like a fast fix, but there are some things to consider that could turn into a major headache. Trust me, you don't want that!

Public Shaming? Not Cool!

These guys might play dirty. If you're even a day late on a payment, they could blast embarrassing messages about your loan to your friends and family. Imagine your phone blowing up with texts saying you owe money! Yikes!

Short Fuse, Big Charges:

They often give you super short deadlines to repay, like 6 to 14 days. That's barely enough time to make coffee, let alone gather the cash, especially if you're already strapped. And here's the kicker: if you miss that deadline, the interest rates go crazy, jumping 2% to 7% every single day. Ouch! That's a recipe for drowning in debt, not climbing out.

Don't Reward Shame with Payment:

Here's the key: if they resort to public shaming, DON'T PAY THEM BACK! They already got their revenge by embarrassing you. Remember, these apps often operate outside the law, so their threats are mostly smoke and mirrors. Don't let them bully you!

Break Free from the Cycle:

The only way to truly escape their grip is to STOP BORROWING from them altogether. I know it's tough, but trust me, it's better than being constantly harassed and stuck in a cycle of debt. You were living before they came along, and you'll find a way again. Be resourceful, be patient, but don't borrow anymore!

Fight Back and Protect Yourself:

To stay safe, use apps like Truecaller to identify their calls and block their numbers. You can also report them directly to WhatsApp and the app store. Let them know their tactics are unacceptable!

Your Worth is Greater Than a Loan:

Remember, your self-respect and well-being are worth more than any quick loan. Don't let LinkCredit or any other app bully you. By staying informed and taking action, you can break free and get back to living life on your own terms. You've got this!

Remember, there are other options. Talk to trusted friends or family, or seek help from organizations that offer financial counseling and support. Don't let loan apps trap you in a cycle of debt and shame. You deserve better!

-

PrimePay - Instant Loan APP

First things first, it's essential to understand some key points about this service. Here's what you need to know:

1. Your contacts might receive SMS notifications claiming that you owe money to PrimePay.

2. If you're just one day overdue, you might start receiving unpleasant messages via WhatsApp from the loan provider.

3. Repayment plans typically range from 6 to 14 days, which can be tough for many borrowers to manage.

4. The interest rates on overdue payments can range from 2% to 7% per day, potentially increasing your debt burden.

5. It's best not to repay them if they resort to defaming you. Remember, they've already received their money, and resorting to defamation is their only way to pressure you.

6. Since these loan apps are unlicensed, their only recourse is through defamation tactics.

7. Borrowing from another loan app to repay PrimePay could worsen your financial situation and lead to serious debt.

8. Installing Truecaller on your mobile phone can help you identify and block calls from PrimePay and similar entities.

9. The most effective solution to escape loan sharks like PrimePay is to stop borrowing altogether.

10. Take proactive steps to block them on WhatsApp and report their activities directly on WhatsApp and Google Play Store.

11. Remember, you have options beyond borrowing from these loan apps. Prioritize your financial well-being and integrity.

-

Swifund

They will send SMS to your contacts, claiming that you owe them money.

Be prepared for a flood of unpleasant WhatsApp messages if you are even a day late.

Their repayment schedules typically range from 6 to 14 days, making it extremely challenging to settle the debt.

Anticipate daily overdue interest rates of 5% to 7%, pushing you further into financial hardship.

Once they tarnish your reputation, there is no point in repaying them. They have already achieved their objective.

Since they lack a license, they are unable to pursue legal action against you. Their only recourse is to damage your reputation.

Refrain from borrowing from other loan apps to repay your debts; this will only exacerbate your financial situation.

Utilize Truecaller to screen and block their calls, sparing yourself unnecessary stress.

The most effective way to escape from loan sharks is to cease borrowing altogether.

Block them on WhatsApp and report them directly to WhatsApp and the Google Play Store to prevent others from falling victim to the same scam.

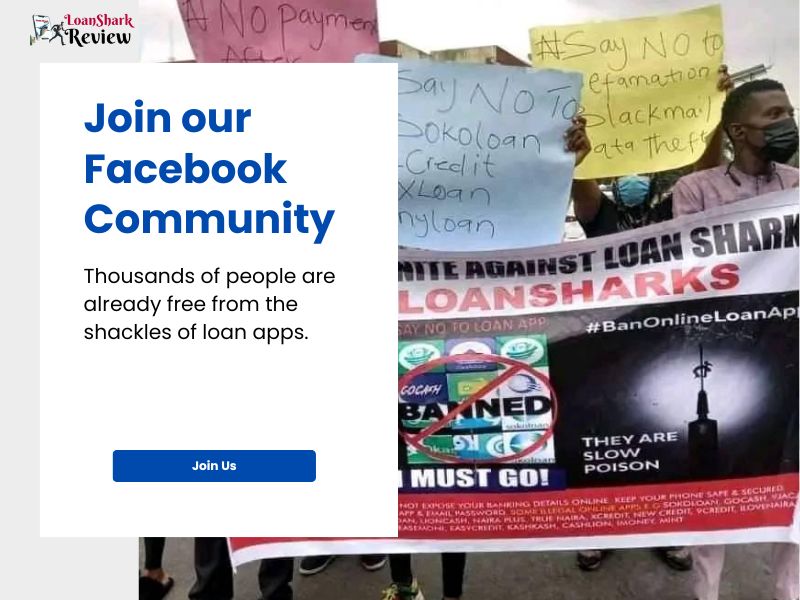

Join our Facebook Group

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.