Expert Review

-

Wind money-credit loan

Loan apps may seem like a quick solution for accessing cash in emergencies, but many of them come with significant risks. If you’re thinking about using an online loan app, it’s essential to be aware of the dangers involved. Here are 10 critical tips to help you navigate this space safely and protect your financial health:

1. Only Download Loan Apps from Official Sources

When installing loan apps, always ensure you're downloading from legitimate platforms, such as the Google Play Store or Apple’s App Store. Unofficial third-party websites or APK files pose a high risk of malware infections and data breaches. In some cases, downloading from unverified sources could lead to the misuse of your personal information, such as giving the app access to your contacts, which may result in unauthorized communication with people in your address book.

2. Prepare for Harassment if You Miss Payments

Loan apps are notorious for using aggressive tactics to collect overdue payments. Even if you are just a day or two late, brace yourself for a barrage of unpleasant and harassing messages, particularly on platforms like WhatsApp. These messages often escalate in tone and frequency, causing emotional stress. If the harassment becomes unbearable, you can block the sender to regain control over your peace of mind. However, remember that blocking doesn't absolve you of the debt, so you must still find a way to resolve the payment issue.

3. Extremely Short Repayment Periods

One of the biggest traps of online loan apps is their short repayment terms, often ranging from just 6 to 14 days. This short window leaves borrowers with little time to repay, forcing many to scramble for funds. In such cases, you may find yourself borrowing again from other sources just to pay off the first loan, creating a dangerous cycle of debt that’s hard to escape.

4. Beware of High Overdue Interest Rates

Missing a payment can quickly become a financial disaster, as many loan apps charge overdue interest rates that range between 5% and 7% per day. Over time, this can lead to significant debt accumulation, making it difficult for you to catch up with your payments. What seemed like a manageable loan at first can balloon into an unmanageable financial burden.

5. Reputation Damage as a Tactic

Some loan apps exploit your personal information to pressure you into repayment by contacting your family members, friends, and colleagues. Public shaming tactics—such as sending messages to your contacts—are used to tarnish your reputation. Once your reputation is damaged, some borrowers feel there’s no reason to repay since the harm has already been done. If you’re faced with this situation, consider creating a public disclaimer to clear your name and counter any false claims the app may have made.

6. Avoid Taking New Loans to Pay Off Old Ones

It may be tempting to borrow from another loan app to cover an existing loan, but this strategy will only deepen your financial troubles. When you take out new loans to settle old debts, you are merely extending your cycle of borrowing, which leads to even higher levels of debt. Instead, seek advice from a financial counselor or look for alternative solutions to manage your repayment.

7. Use Truecaller to Block Harassing Calls

Loan apps are relentless when it comes to making collection calls. Truecaller, a caller ID and call-blocking app, can be an effective tool to screen and block unwanted calls from loan apps and lenders. By using this app, you can reduce the stress caused by constant calls and focus on finding a solution to your financial situation.

8. Break the Borrowing Cycle by Stopping

To truly regain control of your finances, the best solution is to stop borrowing altogether. Although this can be difficult, especially if you’ve become reliant on loans, cutting yourself off from these predatory financial services is critical for breaking free from the cycle of debt. Once you stop borrowing, you can focus on creating a realistic budget and working toward a debt-free future.

9. Block and Report Harassing Loan Apps

If a loan app is sending harassing messages via platforms like WhatsApp, don’t hesitate to block the sender and report them to WhatsApp and the Google Play Store. By doing so, you’re not only protecting yourself but also preventing others from being victimized by the same predatory tactics. Reporting the app to the Play Store can lead to its removal, stopping its harmful practices from spreading.

10. Avoid Loan Apps Altogether

In general, loan apps are often designed to exploit users by trapping them in cycles of debt, imposing high fees, and compromising their personal information. The safest way to protect yourself from the negative impacts of these apps is to avoid them entirely. Look for safer financial alternatives such as credit unions, microfinance banks, or borrowing from family and friends. These alternatives often come with lower interest rates and more favorable repayment terms.

Conclusion

While loan apps may provide a fast and easy way to access cash, they often come with hidden dangers that can wreak havoc on your financial health. By following these 10 tips, you can protect yourself from the damaging effects of predatory loan apps, safeguard your personal information, and make more informed financial decisions.

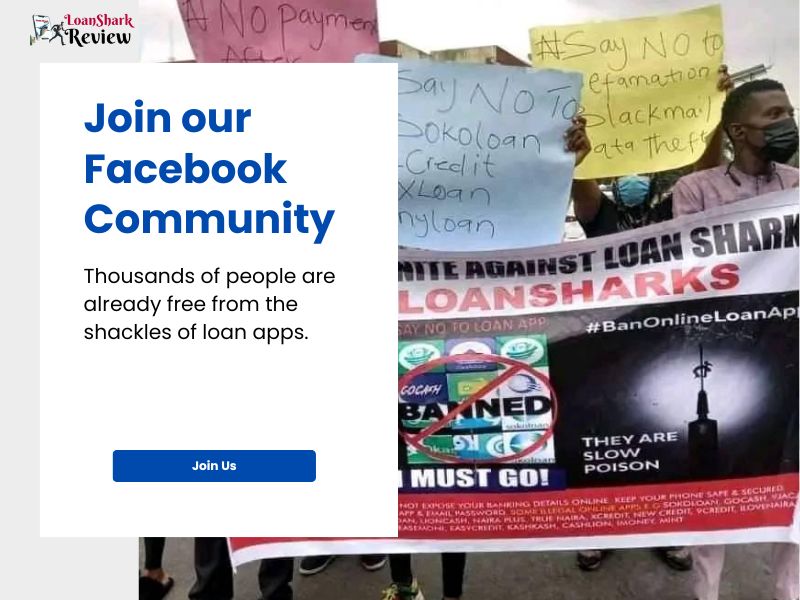

Join our Facebook Group

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.