Expert Review

-

Aje loan

Aggressive Debt Collection

Ajeloan has gained a reputation for its aggressive tactics when collecting debts. If you’re late on a payment, even by a single day, they won’t hesitate to send SMS messages to your phone contacts, informing them about your outstanding debt. On top of that, they may flood your WhatsApp inbox with derogatory and stressful messages, making it a rather unpleasant experience.

High Interest Rates

When it comes to interest rates, Ajeloan isn’t shy about charging steep penalties. For overdue payments, expect interest rates between 5% and 7% per day. These high rates can easily accumulate, pushing you further into debt if you’re not careful.

Handling Defamation

Here’s an important point: once Ajeloan starts tarnishing your reputation, paying them back may not undo the damage. Their goal of defaming you has already been accomplished, and since they operate without a proper license, they have little legal power beyond these smear tactics. Paying them off won’t stop the messages or reverse their actions.

Avoid the Debt Cycle

One of the worst moves you can make is borrowing from another loan app to pay off Ajeloan. Many of these apps are interconnected, so you’ll likely end up transferring debt between different platforms, sinking deeper into financial trouble. It's a vicious cycle that’s hard to escape.

Protect Yourself from Harassment

To avoid Ajeloan’s relentless calls and messages, consider using apps like Truecaller to screen and block their harassment. This can give you some peace of mind and reduce the stress that comes with their debt collection efforts.

Breaking Free from Debt

The most effective way to free yourself from Ajeloan’s grip is to stop borrowing altogether. While it may seem difficult in the short term, cutting off access to new loans is the key to regaining control of your finances and avoiding their high-interest traps.

Stay Smart and Protect Your Future

Your financial well-being is worth far more than any short-term loan. Stay vigilant, be cautious with your borrowing decisions, and don’t allow Ajeloan or similar loan sharks to drag you into a debt spiral.

Take control, protect yourself, and work towards a debt-free future!

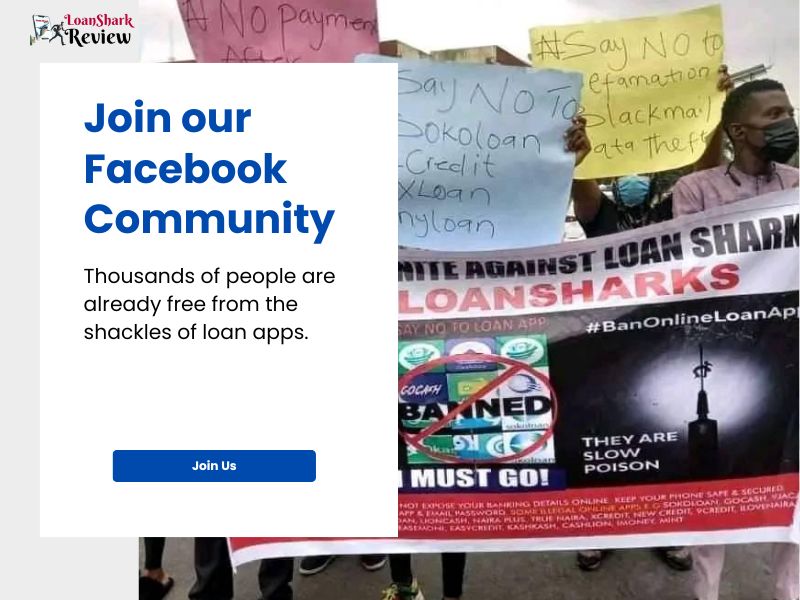

Join our Facebook Group

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.