Expert Review

-

Peso Moca

Loan apps can provide quick, accessible credit with minimal documentation and fast approval. However, many come with high-interest rates, hidden fees, and even predatory practices. Here’s how to avoid loan apps and protect yourself when using them.

How to Avoid Relying on Loan Apps

- Build an Emergency Fund: Save up enough to cover 3-6 months of essential expenses to avoid needing quick loans.

- Create and Stick to a Budget: Track your spending, prioritize necessities over wants, and allocate funds wisely to avoid financial shortfalls.

- Explore Alternative Credit Sources: Consider reputable options like banks, credit unions, or peer-to-peer lending platforms with more favorable terms.

- Improve Your Credit Score: A strong credit score can open doors to lower-interest borrowing options.

- Cut Down on Unnecessary Expenses: Reduce discretionary spending to lessen the need for loans.

Precautions When Using Loan Apps

- Review Terms and Conditions Carefully: Understand interest rates, fees, repayment timelines, and any penalties to avoid surprises.

- Verify Lender Legitimacy: Check the lender’s reputation, licensing, and regulatory compliance before borrowing.

- Borrow Only What You Need: Limit borrowing to essential needs to avoid excessive debt.

- Set Realistic Repayment Goals: Plan your repayment strategy to avoid late penalties and high-interest charges.

- Monitor Your Credit Report: Keep an eye on how loan app transactions affect your credit profile.

Smart Strategies for Loan Repayment

- Make Timely Payments a Priority: Paying on time helps you avoid penalties and additional interest.

- Develop a Repayment Plan: Break down debt into manageable amounts that fit your budget.

- Use Automatic Payments: Set up automatic transfers to ensure payments are made on time.

- Consider Debt Consolidation: Combine multiple debts into a single loan with a lower interest rate to simplify repayment.

- Communicate with Your Lender: If you’re experiencing financial difficulties, reach out to discuss potential extensions or revised payment plans.

What to Do in a Financial Crisis

- Seek Professional Financial Advice: Consult with a financial advisor or credit counselor for guidance.

- Prioritize Essential Expenses: Focus on covering necessities like rent, utilities, and food.

- Negotiate with Creditors: Discuss the possibility of payment extensions or reduced payments with lenders.

- Explore Government Assistance Options: Look into programs like unemployment benefits or financial aid for temporary relief.

- Consider Debt Restructuring: Work with a credit counselor to explore debt reorganization options.

Red Flags to Watch for When Using Loan Apps

- High-Interest Rates: Interest rates above 36% APR are generally considered predatory and should be avoided.

- Hidden Fees: Be cautious of fees for origination, late payments, or prepayment penalties that can inflate costs.

- Unclear Repayment Terms: Ensure you fully understand payment schedules, amounts, and potential penalties.

- Lack of Transparency: Avoid lenders who don’t provide clear, detailed information about their terms.

- Aggressive Marketing Tactics: Be wary of loan providers who use pushy or deceptive advertising.

Additional Tips for Safer Loan App Use

- Know Your Regulators: Familiarize yourself with relevant regulatory bodies, like the Central Bank of Nigeria, to report suspicious lenders.

- Research Loan App Reviews: Check feedback from multiple sources to gauge a lender’s reputation and practices.

- Build Financial Knowledge: Educate yourself on personal finance basics and responsible borrowing to make informed decisions.

By staying informed and cautious, you can navigate loan apps responsibly, protect your finances, and make better borrowing decisions.

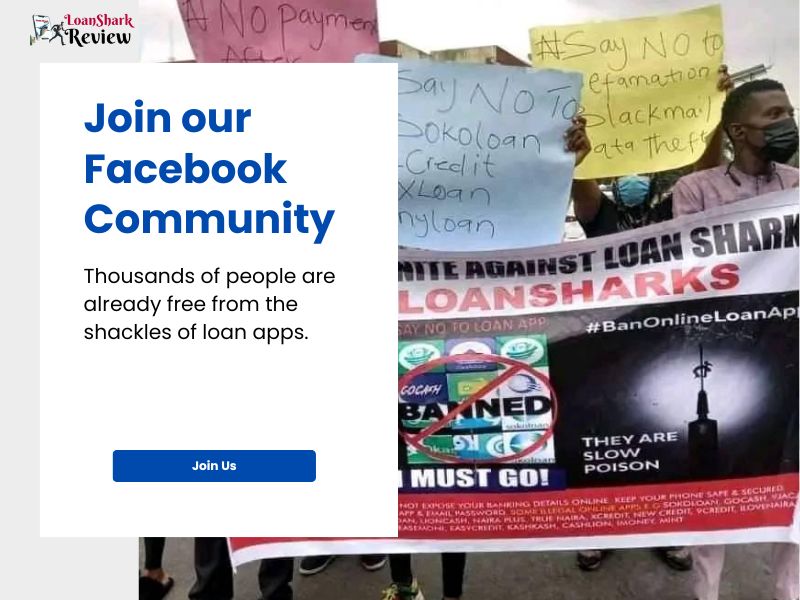

Join our Facebook Group

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.