Expert Review

-

Tiger credit

Let me give you the lowdown on Tiger Credit

- They'll shoot off SMS to your contacts, saying you owe them money.

- Brace yourself for a barrage of nasty WhatsApp messages if you're just a day late.

- Their repayment plans usually last between 6 to 14 days, making it a real struggle to pay up.

- Expect overdue interest rates of 5% to 7% per day, pushing you deeper into debt.

- Don't bother paying them back once they tarnish your name. They've already got what they wanted.

- Since they're not licensed, they can't take legal action against you. Their only weapon is to smear your reputation.

- Avoid borrowing from other loan apps to settle your debts; you'll only dig yourself into a deeper hole.

- Use Truecaller to screen and block their calls, sparing yourself unnecessary stress.

- The best way to break free from loan sharks is to stop borrowing altogether.

- Block them on WhatsApp and report them directly to WhatsApp and Google Play Store to protect others from falling into the same trap.

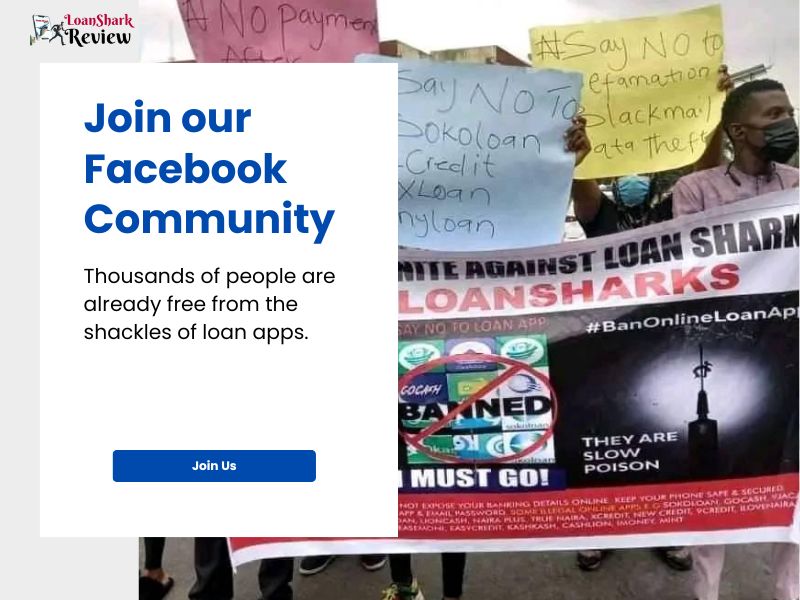

Join our Facebook Group

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.