Expert Review

-

Okash

- Okash is a legit and authorized loan app, so you're in safe hands.

- They won't tarnish your reputation or spread rumors about you.

- If you default on your payments, they'll take the necessary steps and report the matter to the appropriate authorities.

- While their overdue interest rates are fair, you have the option to skip paying them back once you've settled the principal and initial interest.

- Avoid borrowing from other loan apps to settle your debt with Okash. Instead, pay them back when you have the funds available. You can even stretch out your payments over several months, just make sure to honor your commitment.

- Consider installing Truecaller on your phone to identify and block their calls if you'd rather not engage with them.

-

EasyMoni

SMS and Unpleasant Messages:

- So, here’s the deal: when you borrow money from EasyMoni, they might start sending SMS messages to your contacts, telling them that you owe them money. Not cool, right?

- And on WhatsApp, brace yourself! They’ll bombard you with all sorts of not-so-nice messages, starting from just one day overdue. It’s like a digital storm.

Tricky Repayment Plans:

- Now, about paying them back—it’s not a walk in the park. EasyMoni usually gives you a window of 6 to 14 days to repay. But honestly, it feels like climbing Mount Everest without proper gear.

Interest Rates That Sting:

- Hold on tight! Their overdue interest rates range from 2% to a whopping 7% per day. Imagine that—your debt snowballing faster than a rolling boulder.

Defamation Drama:

- Here’s the twist: don’t rush to pay them back just because they’re spreading rumors about you. Nope! They’ve already pocketed their cash by tarnishing your name.

- These loan apps can’t legally chase you down, but they sure know how to sling mud.

No Borrowing from Sibling Apps:

- Listen up: don’t borrow from another loan app to pay off EasyMoni. It’s like trying to put out a fire with gasoline.

- These apps are like a big family—they’re all connected. If you borrow from one, you’ll end up owing them all!

Truecaller to the Rescue:

- Install Truecaller on your phone—it’s like having a superhero caller ID. You’ll know who’s calling, and you can dodge their calls like a ninja.

- Block their numbers and keep your peace of mind intact.

The Ultimate Escape Plan:

- Ready for the magic trick? Stop borrowing altogether. Yep, that’s the secret to breaking free from these loan sharks.

- Block them on WhatsApp and report their shenanigans directly on WhatsApp and Google Play store.

Your Integrity Matters Most:

- Remember, you were doing just fine before these loan apps barged in. Don’t let them mess with your reputation.

- You’ve got this! 🌟

-

Renmoney

Let's dive into Renmoney and what you need to know about borrowing from them.

First off, Renmoney is a legit and approved loan provider. That means they're all above board and have the necessary permissions to operate. You can trust them to handle your loan responsibly.

Now, here's the good news: Renmoney won't tarnish your reputation. They're not in the business of defaming their customers, so you won't have to worry about receiving any embarrassing messages from them.

But, and here's the important bit, if you default on your payments, Renmoney won't hesitate to report you to the authorities. So, it's crucial to stay on top of your repayments and honor your commitments.

Speaking of repayments, Renmoney's overdue interest rates are pretty reasonable. However, if you've already paid off the capital and initial interest, you have the option to skip the overdue interest. Just make sure to clear your dues on time to avoid any issues.

Now, here's a golden rule: never borrow from one loan app to pay off another. It's a recipe for disaster and will only land you in more trouble. Instead, only borrow from Renmoney when you have the means to repay, and spread your payments over several months if needed. Just make sure you stick to your repayment plan and pay them what you owe.

For added peace of mind, consider installing Truecaller on your phone. This handy app can help you screen calls and avoid Renmoney's calls if you're not in the mood to chat.

So, there you have it. Renmoney is a trustworthy loan provider, but it's essential to borrow responsibly and honor your commitments. With the right approach, you can make borrowing from Renmoney work for you.

-

Branch

Branch Loan App is a safe lending platform approved by the Federal government. They prioritize customer privacy and won't contact your phone contacts or guarantors. However, it's crucial to repay overdue loans promptly. Branch Loan App is a registered Microfinance Bank and can report unpaid debts to credit bureaus, which may harm your credit score. This could affect your ability to obtain loans from other financial institutions such as Banks in Nigeria, and rebuilding your credit score may take up to 6 months, even after repayment.

If you have outstanding loans with Branch Loan App, consider repaying them at a comfortable pace. You can spread your payments over several months, such as ₦2,000 per month, depending on your outstanding balance. Avoid rushing to repay all at once to avoid undue pressure.

Always repay Branch Loan App in installments. Avoid borrowing from other loan apps to settle your debts, as this may lead to further financial difficulties.

-

FairMoney

Let's talk about FairMoney and what you need to know to navigate your borrowing journey smoothly.

First off, FairMoney is different from your typical loan app. They won't resort to defaming you or harassing your contacts if you fall behind on payments. Instead, they take a more professional approach and report any delinquent accounts to the appropriate authorities. It's a more respectful way of handling things, don't you think?

Now, when it comes to overdue interest, FairMoney is pretty fair (hence the name). Their rates are reasonable, and if you've paid off the capital and initial interest, you can decide not to pay the overdue interest. It's a nice little perk that gives you some flexibility in managing your finances.

Here's a golden rule: never borrow from another loan app to repay FairMoney. It's a slippery slope that can lead to even more debt. Instead, only borrow what you need when you have the money, and make sure to spread out your payments over several months. That way, you can stay on top of your finances without feeling overwhelmed.

To help you avoid any unwanted calls from FairMoney, consider installing Truecaller on your phone. This handy app can identify incoming calls and allow you to block them if you prefer not to answer. It's a simple but effective way to maintain some peace and quiet.

So, there you have it. FairMoney is a reliable option for borrowing money when you need it most. Just remember to borrow responsibly, stay on top of your payments, and you'll be well on your way to financial freedom.

Take care, and happy borrowing!

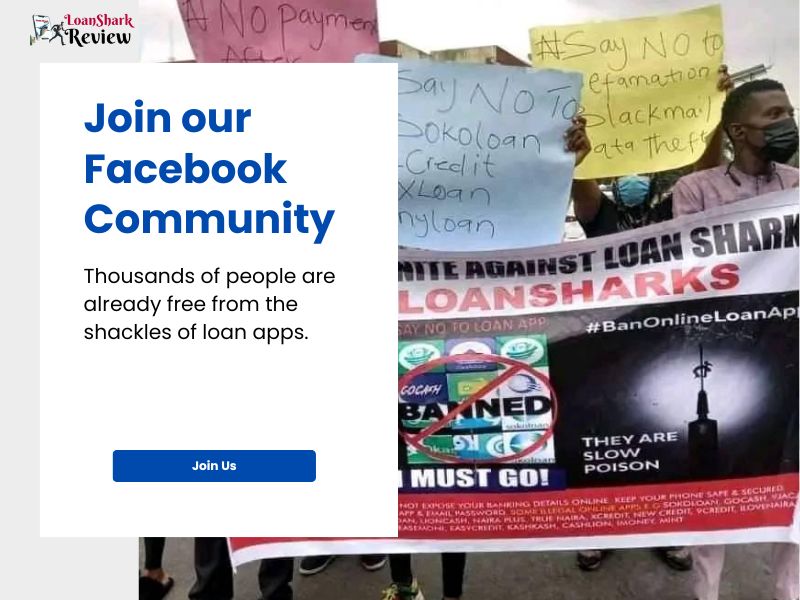

Join our Facebook Group

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.