Expert Review

-

LCredit Max

Allow me to shed some light on LCredit and what you need to know to safeguard your financial well-being.

To begin with, LCredit has a rather aggressive approach when it comes to debt collection. They won't hesitate to bombard every single one of your contacts with automated calls, making sure everyone knows about your outstanding debt. And if that's not enough, they'll also flood your WhatsApp with derogatory messages if you're just one day overdue. It's not a pleasant experience, to say the least.

Now, let's talk about their repayment plans. LCredit typically offers repayment periods ranging from 6 days to 14 days, which can be quite challenging to meet. And to make matters worse, their overdue interest rates can soar as high as 5% to 7% per day, pushing you further into the abyss of debt.

Here's a crucial piece of advice: once LCredit starts defaming you, don't even think about paying them back. They've already gotten what they wanted, and paying them won't make the derogatory messages disappear. Plus, since they're not licensed, they don't have much legal recourse besides tarnishing your reputation.

Whatever you do, resist the temptation to borrow from another loan app to repay LCredit. They have a plethora of apps scattered across mobile app stores, so if you think you're escaping one debt by borrowing from another, think again. You'll only find yourself sinking deeper into financial trouble.

To shield yourself from LCredit's relentless harassment, consider installing Truecaller on your mobile phone. This handy app can help you identify and block their calls, giving you some much-needed peace of mind.

Ultimately, the best way to break free from LCredit's clutches is to stop borrowing altogether. It might not be easy, but it's the only way to avoid getting caught in their web of debt.

Take care, and remember that your financial well-being is worth more than any loan. Stay vigilant, make wise borrowing decisions, and don't let LCredit or any other loan shark drag you down.

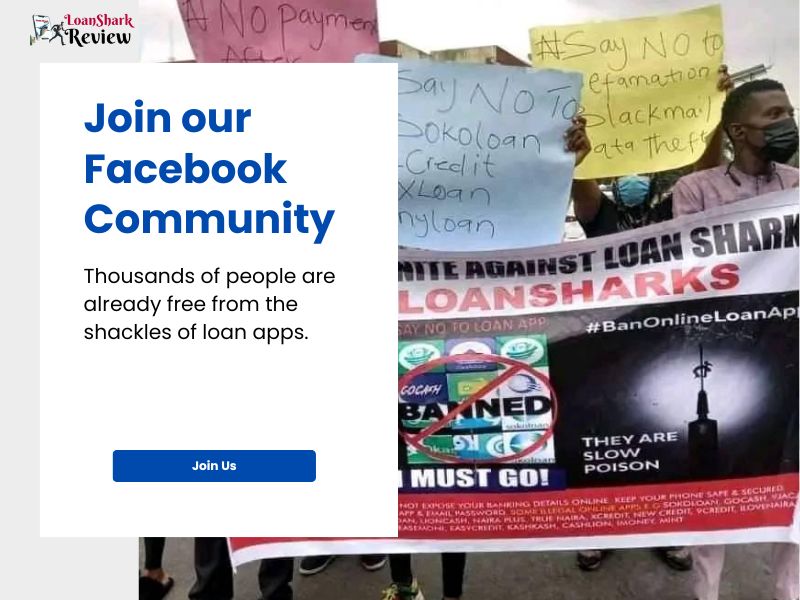

Join our Facebook Group

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.