Expert Review

-

Rocket Loan

No Public Shaming, But Gentle Nudges: They won't blast your contacts like some loan sharks, but expect friendly (or not-so-friendly) reminders to pay up. Remember, open communication is key, so talk to them about your repayment plan if needed.

Overdue Fees: Pay or Don't, It's Up to You: Like most loan apps, they charge extra for late payments. But here's the twist: once you pay the original loan and regular interest, you don't have to pay the late fees. Sounds good, right? Just remember, paying them all off helps your credit score.

Block Annoying Calls (But Maybe Don't): If their reminders feel like harassment, use Truecaller to block their numbers. However, blocking completely might shut off potential repayment solutions.

Say NO to the Debt Spiral: This one's crucial! Only use Rocket Loan if you're 100% sure you can repay on time. Borrowing from another app to pay them is a recipe for disaster!

Truecaller for Selective Blocking: You can use Truecaller to identify and block their calls if needed. But remember, clear communication is often better than shutting them out completely.

Your Options Are Wide Open: Don't feel pressured to borrow if you're not comfortable. Explore other solutions like budgeting, finding extra income, or seeking financial advice before jumping into any loan, even one with "secure savings" in the name.

Your Well-being is Top Priority: Remember, your financial peace of mind and good credit score are crucial. Use Rocket Loan responsibly and only if you understand their terms, interest rates, and repayment options. It's always best to borrow what you can truly afford to pay back.

In the end, there's no magic app for instant wealth. Be cautious, make informed decisions, and remember, you have options beyond loan apps!

-

Daily loan

Welcome to the DailyLoan App

DailyLoan, a premier financial service provider, operates under the reputable New Edge Finance umbrella, a well-established financial institution known for its diverse portfolio. New Edge Finance also owns popular services such as Easybuy and offers a range of applications including Palmcredit, Xcrosscash, Newcredit, and others, all conveniently available on the Google Play Store.

Commitment to Borrowers

One of the standout features of DailyLoan is its dedication to fostering respectful and fair relationships with borrowers. Our platform allows you to repay your loans gradually, free from the fear of defamation or negative repercussions. This commitment creates a supportive environment, encouraging trust and cooperation between borrowers and our team.

Smooth Repayment Process

To facilitate an effortless repayment experience, we advise borrowers against paying any overdue interest once the principal and normal interest amounts have been settled. This approach helps you manage your finances more effectively and avoid unnecessary stress.

Privacy and Communication

Should you experience persistent communication from DailyLoan via phone calls or WhatsApp messages, you have the option to block these contacts. This feature empowers you to protect your privacy and maintain peace of mind, minimizing any disruptions to your daily life.

Responsible Borrowing Practices

We strongly recommend against borrowing from other loan apps to settle dues with DailyLoan, as this can lead to further financial strain and a cycle of debt accumulation. It's essential to stay mindful of your financial commitments and avoid unnecessary borrowing.

Enhanced Communication Control

For added control over your communication channels, consider installing Truecaller on your mobile device. Truecaller helps you identify and block spam calls, including those from lenders like DailyLoan, ensuring an extra layer of security and convenience.

Thank you for choosing DailyLoan. We are here to support your financial journey with respect and understanding!

-

-

Cashwise

They'll shoot off SMS to your contacts, saying you owe them money.

Brace yourself for a barrage of nasty WhatsApp messages if you're just a day late.

Their repayment plans usually last between 6 to 14 days, making it a real struggle to pay up.

Expect overdue interest rates of 5% to 7% per day, pushing you deeper into debt.

Don't bother paying them back once they tarnish your name. They've already got what they wanted.

Since they're not licensed, they can't take legal action against you. Their only weapon is to smear your reputation.

Avoid borrowing from other loan apps to settle your debts; you'll only dig yourself into a deeper hole.

Use Truecaller to screen and block their calls, sparing yourself unnecessary stress.

The best way to break free from loan sharks is to stop borrowing altogether.

Block them on WhatsApp and report them directly to WhatsApp and Google Play Store to protect others from falling into the same trap.

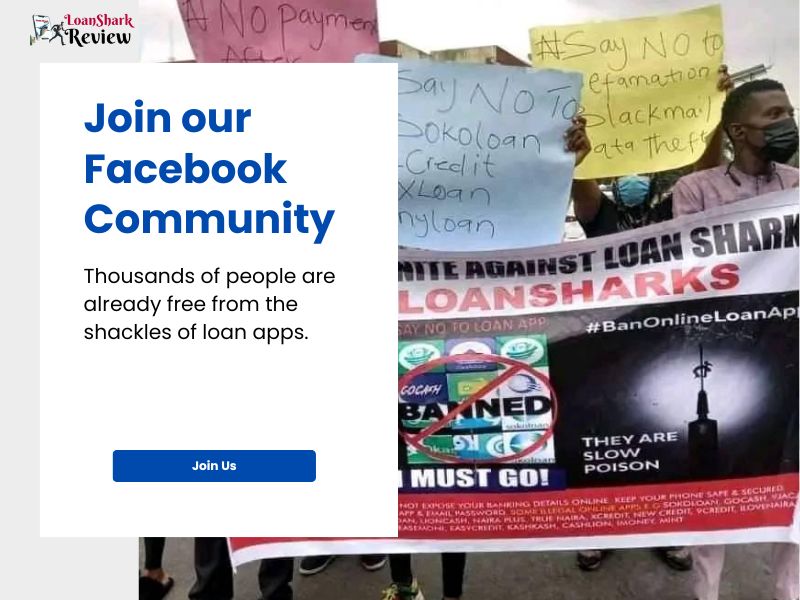

Join our Facebook Group

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.