Expert Review

-

Silk loan

When using Silk Loan App, it’s crucial to be aware of the following potential risks and practices that may affect your financial well-being:

1. Broadcasting Your Debt

Silk Loan App may notify your contacts via SMS regarding your outstanding debt. This tactic aims to exert pressure on you by involving your personal network.

2. Harassment on WhatsApp

If you miss a payment, be prepared for aggressive and relentless messages on WhatsApp. Even a single day of delay can trigger a wave of distressing communications.

3. Tight Repayment Window

The repayment periods offered by Silk Loan App are typically very short, often ranging from just 6 to 14 days. This limited timeframe can create significant pressure and make it challenging for borrowers to meet their obligations.

4. High Interest on Overdue Payments

If you fail to repay on time, be cautious of their exorbitant overdue interest rates, which can escalate rapidly from 1% to 5% per day. This can quickly deepen your financial burden and lead to unmanageable debt.

5. Reputation Over Debt

Once Silk Loan App begins defaming you, simply paying back the loan may not restore your reputation. Their primary objective is to tarnish your name, which they accomplish through public shaming tactics.

6. Unlicensed and Defamatory Tactics

Silk Loan App often operates without proper licensing and resorts to defamation as a means of coercing repayment. This unscrupulous behavior can leave borrowers feeling vulnerable and powerless.

7. Avoid Borrowing from Other Loan Apps

Steer clear of the trap of taking out additional loans from other apps to repay Silk Loan App. This strategy often leads to a vicious cycle of debt, making your financial situation even worse.

8. Block Their Calls

Utilize call management apps like Truecaller to identify and block persistent calls from Silk Loan App. This can significantly reduce the stress of constant harassment.

9. Break Free from the Cycle

The most effective way to regain control over your finances is to cease borrowing from Silk Loan App entirely. While it may be difficult, breaking free from their grip is essential for your financial health.

10. Take Action

Don't hesitate to block them on WhatsApp, and report any abusive behavior to WhatsApp and the Google Play Store. Protecting yourself from their unscrupulous tactics is vital.

11. Stay in Control

Remember that you managed your finances effectively before Silk Loan App entered the picture. Do not allow their manipulative practices to harm your reputation or drain your resources.

By staying informed and proactive, you can safeguard yourself against the negative consequences of using Silk Loan App and maintain control over your financial future.

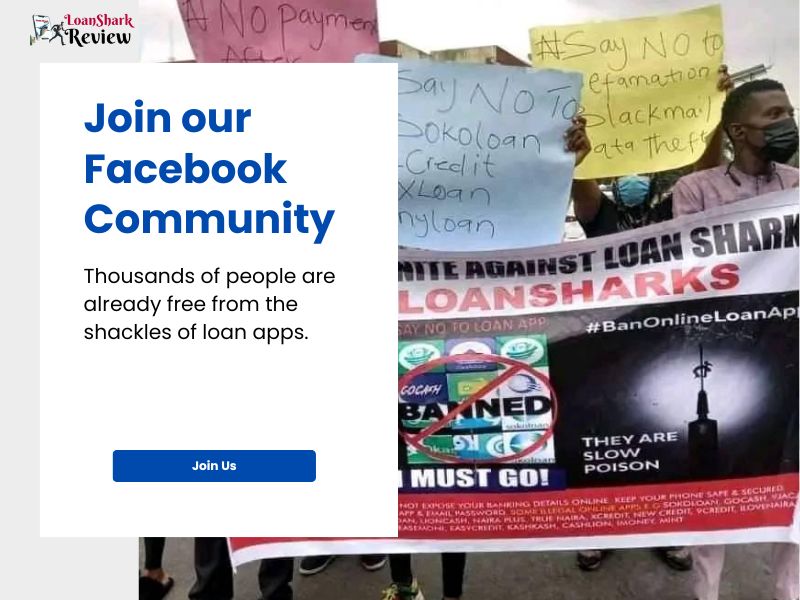

Join our Facebook Group

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.