Expert Review

-

LairaPlus-Online

LairaPlus-Online and what you need to know to stay safe in your borrowing journey.

First off, LairaPlus-Online isn't exactly known for playing nice when it comes to debt collection. If you're overdue on your payments, brace yourself for a barrage of SMS messages to your contacts, letting them know about your outstanding debt. And if that's not enough, they'll start bombarding your WhatsApp with all sorts of derogatory messages, starting as soon as you're just one day overdue. It's not a pleasant experience, to say the least.

Now, let's talk about their interest rates. Hold onto your hats because they're on the steep side. LairaPlus-Online charges anywhere between 5% to 7% per day for overdue payments. That's a hefty sum, and if you're not careful, it can quickly snowball into an avalanche of debt.

Here's the kicker: once LairaPlus-Online starts defaming you, don't bother trying to pay them back. They've already gotten what they wanted, and paying them won't make the derogatory messages disappear. Plus, since they're not licensed, they don't have much legal recourse besides tarnishing your reputation.

Whatever you do, don't fall into the trap of borrowing from another loan app to repay LairaPlus-Online. They have a whole arsenal of mobile apps under their belt, so if you think you're escaping one debt by borrowing from another, think again. You'll only find yourself sinking deeper into financial trouble.

To shield yourself from LairaPlus-Online's relentless harassment, consider installing Truecaller on your phone. This handy app can help you identify and block their calls, giving you some much-needed peace of mind.

In the end, the best way to break free from LairaPlus-Online's grip is to stop borrowing altogether. It might not be easy, but it's the only way to avoid getting caught in their web of debt.

Remember, your financial well-being is worth more than any loan. So, stay vigilant, be smart about your borrowing decisions, and don't let LairaPlus-Online or any other loan shark drag you down.

-

Loan Naira

When dealing with Loan Naira, it's crucial to understand certain aspects of repayment. Here's what you need to know:

Derogatory Messages: If Loan Naira has sent disrespectful or offensive messages to your contacts, it can be harmful and embarrassing. However, once they've crossed that line, paying them back may not resolve the issue. Consider seeking legal recourse instead.

Defamation: If Loan Naira has already tarnished your reputation with derogatory messages, paying them back may not undo the damage. It's important to weigh your options and consider seeking legal advice.

Install TrueCaller: TrueCaller is a phone app that helps identify and block spam calls. Installing this app can help you identify and block unwanted calls from Loan Naira.

Block Auto Debit: To prevent Loan Naira from automatically debiting money from your bank account, it's important to block your bank card. Visit your bank to request a new card.

Block on WhatsApp: You can block Loan Naira's contact on WhatsApp to stop receiving messages from them. Additionally, report them on WhatsApp to alert the platform about their behavior.

Report to App Stores: If Loan Naira is available on Google Play Store or iOS, report the app to the respective app store. This helps warn others about the app's behavior and may result in its removal from the store.

Taking these steps can help protect yourself from further harm or harassment by Loan Naira.

-

Renmoney

Let's dive into Renmoney and what you need to know about borrowing from them.

First off, Renmoney is a legit and approved loan provider. That means they're all above board and have the necessary permissions to operate. You can trust them to handle your loan responsibly.

Now, here's the good news: Renmoney won't tarnish your reputation. They're not in the business of defaming their customers, so you won't have to worry about receiving any embarrassing messages from them.

But, and here's the important bit, if you default on your payments, Renmoney won't hesitate to report you to the authorities. So, it's crucial to stay on top of your repayments and honor your commitments.

Speaking of repayments, Renmoney's overdue interest rates are pretty reasonable. However, if you've already paid off the capital and initial interest, you have the option to skip the overdue interest. Just make sure to clear your dues on time to avoid any issues.

Now, here's a golden rule: never borrow from one loan app to pay off another. It's a recipe for disaster and will only land you in more trouble. Instead, only borrow from Renmoney when you have the means to repay, and spread your payments over several months if needed. Just make sure you stick to your repayment plan and pay them what you owe.

For added peace of mind, consider installing Truecaller on your phone. This handy app can help you screen calls and avoid Renmoney's calls if you're not in the mood to chat.

So, there you have it. Renmoney is a trustworthy loan provider, but it's essential to borrow responsibly and honor your commitments. With the right approach, you can make borrowing from Renmoney work for you.

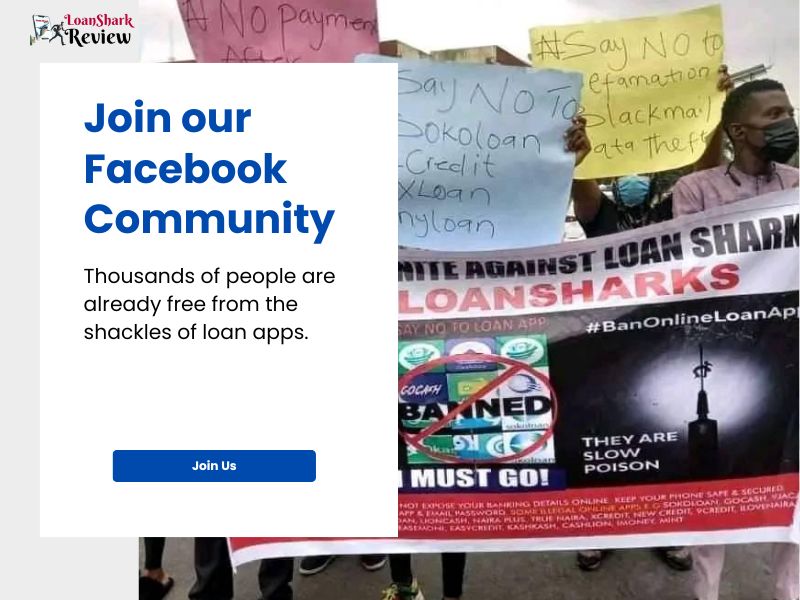

Join our Facebook Group

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.