Expert Review

-

Ultracash

They'll shoot off SMS to your contacts, saying you owe them money.

Brace yourself for a barrage of nasty WhatsApp messages if you're just a day late.

Their repayment plans usually last between 6 to 14 days, making it a real struggle to pay up.

Expect overdue interest rates of 5% to 7% per day, pushing you deeper into debt.

Don't bother paying them back once they tarnish your name. They've already got what they wanted.

Since they're not licensed, they can't take legal action against you. Their only weapon is to smear your reputation.

Avoid borrowing from other loan apps to settle your debts; you'll only dig yourself into a deeper hole.

Use Truecaller to screen and block their calls, sparing yourself unnecessary stress.

The best way to break free from loan sharks is to stop borrowing altogether.

Block them on WhatsApp and report them directly to WhatsApp and Google Play Store to protect others from falling into the same trap.

-

9Money

Let's discuss 9Money and its operations. Firstly, it's important to note that this platform is owned by Sokoloan company and is notorious for sending defamatory messages to your contacts.

Instead of directly informing you of your outstanding debt, they resort to sending SMS messages to your contacts, informing them of your financial obligations. Moreover, they escalate their tactics by sending derogatory messages via WhatsApp, starting as early as one day after your repayment deadline.

9Money typically offers repayment plans spanning from 6 to 14 days, which can pose a significant challenge for borrowers to fulfill. Adding to the burden is their exorbitant overdue interest rates, ranging from 5% to 7% per day, which can swiftly spiral borrowers into deeper debt.

It's imperative not to succumb to their demands for repayment once they besmirch your reputation. Their primary leverage stems from defamation, as they lack legal authorization as loan apps. Attempting to borrow from other loan apps to repay them only exacerbates your financial predicament, as you might inadvertently find yourself borrowing from them again, perpetuating a cycle of indebtedness.

To shield yourself from their incessant harassment, consider installing Truecaller on your mobile device to identify and block their calls. Additionally, take proactive measures by blocking them on WhatsApp and reporting their activities directly on WhatsApp and Google Play Store.

-

Secucash

1. They may send SMS notifications to your contacts indicating that you owe them money.

2. If you're just one day overdue, you might receive unpleasant messages via WhatsApp from the loan provider.

3. Repayment plans typically range from 6 to 14 days, which can be challenging for many borrowers.

4. The interest rates on overdue payments can range from 2% to 7% per day, potentially increasing your debt significantly.

5. It's not advisable to repay them if they resort to defaming you. Remember, they've already received their money, and resorting to defamation is their only means of recourse.

6. Since these loan apps are unlicensed, their only recourse is through defamation tactics.

7. Borrowing from another loan app to settle debts with Secucash could worsen your financial situation and lead to serious debt.

8. Consider installing Truecaller on your mobile phone to identify and block calls from Secucash and similar entities.

9. The best solution to break free from loan sharks like Secucash is to stop borrowing altogether.

10. Take proactive steps to block them on WhatsApp and report their activities directly on WhatsApp and Google Play Store.

11. Remember, there are other ways to manage without borrowing from these loan apps. Prioritize your financial well-being and integrity.

-

Carefinance

Let's dive into Carefinance and what you need to know:

They might shoot SMS to your pals saying you owe them cash.

Prepare for all sorts of not-so-nice messages on WhatsApp as soon as you're a day late.

Their repayment window is tight, usually from 7 to 14 days. Tough, right?

Watch out for the extra fees if you're late. It can be anywhere from 1% to 5% per day and will only push you deeper into debt.

Don't rush to pay them off if they start spreading rumors about you. They benefit when they trash your rep.

Don't sweat it too much. These loan apps aren't licensed, so they're all bark and no bite. Defamation is their only weapon.

Whatever you do, don't borrow from another app to pay them. It's a never-ending cycle of debt. They've got tons of apps out there, so you might just end up borrowing from them again.

Grab Truecaller for your phone. It helps you screen calls and block their numbers.

The real fix? Stop borrowing altogether. It's the only way to break free from these loan sharks.

Block them on WhatsApp and make sure to report their shady tactics to WhatsApp and the Google Play Store.

Remember, you were doing just fine before these loan apps showed up. Don't let them ruin your life. You've got this!

-

9Credit

Let's address 9Credit and its operations. To begin, it's essential to understand that regardless of the loan amount provided, repayment must occur within a maximum period of 7 days, as their repayment tenure does not exceed this timeframe.

Moreover, instead of directly contacting you about outstanding debts, 9Credit opts to send SMS notifications to your contacts, informing them of your indebtedness. Additionally, if you fail to meet repayment deadlines, they resort to sending disparaging messages via WhatsApp to your contacts, starting as soon as one day after the due date.

Typically, their repayment plans span from 6 to 14 days, presenting challenges for borrowers in meeting their financial obligations. Adding to the burden is the high overdue interest rate, ranging between 5% to 7% per day, which can quickly escalate your debt.

It's important to refrain from repaying them once they resort to defaming you, as this only serves to enrich them. Despite being unlicensed loan apps, 9Credit and similar services lack legal authority. Their primary recourse is to tarnish your reputation.

Attempting to borrow from other loan apps to repay 9Credit only worsens your financial situation. Given their multiple apps available on mobile app stores, borrowing from another source may inadvertently lead to borrowing from them again, plunging you into further debt.

Consider installing Truecaller on your mobile device to identify and block their calls, providing a measure of protection. Additionally, blocking them on WhatsApp and reporting their activities directly on WhatsApp and Google Play Store can serve as deterrents.

Ultimately, the most effective solution to break free from the grip of loan sharks like 9Credit is to cease borrowing altogether. By taking control of your finances and avoiding further indebtedness, you can safeguard your financial well-being in the long run.

-

Tloan

Tloan, These guys might seem like a quick fix, but trust me, they can turn into a major headache. Here's the lowdown on why you should steer clear:

1. Shameful Tactics: Forget polite reminders. These apps blast your contacts, painting you as a defaulter even after a day's delay. They might even spam your WhatsApp with nasty messages, tarnishing your reputation in a heartbeat.

2. Crushing Deadlines: They offer loans with super-short repayment periods, like 6-14 days. It's like setting you up to fail, leading to...

3. Debt Spiral: Their insane interest rates (think 2% to 7% per DAY!) trap you in a cycle of debt. Borrowing from another app to pay them off? Bad idea. You'll just end up deeper in their clutches.

4. Empty Threats: Don't let their bullying tactics scare you. These apps often operate outside the law, so their threats are mostly just noise. They can't really do anything to you, except try to shame you.

5. Breaking Free: Here's the key: stop borrowing. It's tough, but it's the only way to escape their grip. Remember, you survived before they came along. You can do it again.

Here's your action plan:

- Install Truecaller: Identify and block their calls.

- Block them on WhatsApp: Cut off communication.

- Report them: Flag them on WhatsApp and the app store.

- Seek help: Talk to trusted friends or family, or consider professional financial advice.

Remember, your dignity and peace of mind are worth more than any quick loan. Don't let these loan sharks drag you down. Take back control and build a brighter future, one step at a time.

-

Fitloan

They'll shoot off SMS to your contacts, saying you owe them money.

Brace yourself for a barrage of nasty WhatsApp messages if you're just a day late.

Their repayment plans usually last between 6 to 14 days, making it a real struggle to pay up.

Expect overdue interest rates of 5% to 7% per day, pushing you deeper into debt.

Don't bother paying them back once they tarnish your name. They've already got what they wanted.

Since they're not licensed, they can't take legal action against you. Their only weapon is to smear your reputation.

Avoid borrowing from other loan apps to settle your debts; you'll only dig yourself into a deeper hole.

Use Truecaller to screen and block their calls, sparing yourself unnecessary stress.

The best way to break free from loan sharks is to stop borrowing altogether.

Block them on WhatsApp and report them directly to WhatsApp and Google Play Store to protect others from falling into the same trap.

-

WeCredit

While it might seem like a magic wand, there are some things to consider that could turn into a major headache. Remember, knowledge is power!

Public Shame? No Thanks!

These guys might not play nice. If you're even a day late on a payment, they could blast embarrassing messages about your loan to your friends and family. Imagine your phone blowing up with texts saying you owe money! Not cool, right?

Short Fuse, Big Charges:

They often give you super short deadlines to repay, like 6 to 14 days. That's barely enough time to make instant noodles, let alone gather the cash, especially if you're already strapped. And here's the kicker: if you miss that deadline, the interest rates go crazy, jumping 2% to 7% every single day. Ouch! That's like jumping from a frying pan into a fire, not getting out of debt.

Don't Reward Shame with Payment:

Here's the key: if they resort to public shaming, DON'T PAY THEM BACK! They already got their revenge by embarrassing you. Remember, these apps often operate outside the law, so their threats are mostly smoke and mirrors. Don't let them bully you!

Break Free from the Cycle:

The only way to truly escape their grip is to STOP BORROWING from them altogether. I know it's tough, but trust me, it's better than being constantly harassed and stuck in a cycle of debt. You were living before WeCredit, and you'll find a way again. Be creative, be patient, but don't borrow anymore!

Fight Back and Protect Yourself:

To stay safe, use apps like Truecaller to identify their calls and block their numbers. You can also report them directly to WhatsApp and the app store. Let them know their tactics are unacceptable!

Your Worth is More Than a Loan:

Remember, your self-respect and well-being are worth more than any quick loan. Don't let WeCredit or any other app bully you. By staying informed and taking action, you can break free and get back to living life on your own terms. You've got this!

Remember, there are other options. Talk to trusted friends or family, or seek help from organizations that offer financial counseling and support. Don't let loan apps trap you in a cycle of debt and shame. You deserve better!

-

Nairamax (naira max)

- They will send SMS messages to your contacts, claiming that you owe them money.

- Prepare yourself for an onslaught of unpleasant WhatsApp messages if you are even a day late.

- Their repayment schedules typically range from 6 to 14 days, making it extremely challenging to settle your debts.

- Anticipate daily overdue interest rates ranging from 5% to 7%, pushing you further into debt.

- Once they tarnish your reputation, there is no need to repay them. They have already achieved their goal.

- Since they lack a license, they are unable to pursue legal action against you. Their sole tactic is to damage your reputation.

- Avoid borrowing from other loan apps to clear your debts; this will only worsen your situation.

- Utilize Truecaller to screen and block their calls, sparing yourself unnecessary stress.

- The most effective way to break free from loan sharks is to cease borrowing altogether.

- Block them on WhatsApp and report them directly to WhatsApp and Google Play Store to prevent others from falling victim to the same scheme.

-

Xcash

Xcash, a leading financial service provider, operates under the umbrella of New Edge Finance, a renowned financial institution with an extensive portfolio. Notably, New Edge Finance also owns Easybuy and boasts a diverse range of apps, including Palmcredit, Xcrosscash, Newcredit, and many more, available on Google Play Store.

One distinguishing feature of Xcash is its commitment to fair and respectful borrower relations. Borrowers can repay their loans gradually without fear of defamation or negative consequences from the platform, fostering a trusting and supportive environment for borrowers.

To ensure a smooth repayment process, borrowers are advised against paying overdue interest once the normal interest and capital amounts have been settled. This practice helps borrowers manage their finances effectively and avoid unnecessary financial strain.

In the event of persistent communication from Xcash via calls or WhatsApp messages, borrowers have the option to block their contacts and WhatsApp numbers. This proactive step enables borrowers to maintain their privacy and peace of mind, minimizing potential disruptions.

It is strongly recommended that you refrain from borrowing from other loan apps to settle dues with Xcash. Doing so may exacerbate financial challenges and lead to a cycle of debt accumulation.

For enhanced control over communication channels, you can leverage Truecaller by installing it on their mobile phones. Truecaller empowers you to identify and block spam calls, including those from lenders like Xcash, providing an added layer of security and convenience.

-

Xcrosscash

Xcrosscash is a lending platform that offers financial assistance to individuals in need. Here are some important points to know about their services:

1. Respectful Repayment Process: Xcrosscash does not engage in defamatory practices if borrowers pay their dues gradually until the full repayment is completed. This means that borrowers can manage their repayment schedule at their own pace without facing any negative repercussions from the platform.

2. Interest Payment Guidelines: It is advisable not to pay overdue interest after settling the normal interest and capital amount. By adhering to this guideline, you can avoid unnecessary financial burden and ensure a smoother repayment process.

3. Communication Management: In case you experience persistent communication from Xcrosscash via calls or WhatsApp messages, it is recommended to block their contacts and WhatsApp numbers. This step can help you maintain their peace of mind and avoid unnecessary disturbances.

4. Avoid Borrowing to Repay: You should refrain from borrowing from another loan app to repay their dues to Xcrosscash. Doing so can lead to a cycle of debt and financial instability, which may exacerbate the existing financial challenges.

5. Utilize Truecaller for Blocking: Installing Truecaller on a mobile phone can be beneficial for you who wish to block unwanted calls from Xcrosscash. This app allows users to identify and block spam calls, including those from lenders, thus providing added control over communication channels.

By understanding and adhering to these guidelines, you can effectively manage their repayment journey with Xcrosscash and maintain a positive financial standing.

-

Palmcredit

Palmcredit is a reputable lending platform that prioritizes borrower satisfaction and provides valuable financial assistance. Here are some essential aspects to consider when engaging with Palmcredit:

After 30 days you'll stop receiving calls and messages from them

Respectful Repayment Approach: Palmcredit upholds a respectful approach towards repayment. They do not engage in defamatory practices if borrowers opt to repay gradually until the full amount is settled. This allows borrowers to manage their repayment schedule at their own pace without facing any negative consequences from the platform.

Interest Payment Guidelines: Borrowers are advised not to pay overdue interest after clearing the normal interest and capital amount. Following this guideline helps borrowers avoid unnecessary financial strain and ensures a smoother repayment process.

Communication Management: In cases where borrowers experience persistent communication from Palmcredit via calls or WhatsApp messages, it is advisable to block their contacts and WhatsApp numbers. This proactive step empowers borrowers to maintain their peace of mind and minimize potential disturbances.

Avoid Borrowing to Repay: It is strongly discouraged to borrow from another loan app to settle dues with Palmcredit. Engaging in such practices may lead to a cycle of debt and financial instability, exacerbating existing financial challenges.

Utilize Truecaller for Blocking: Installing Truecaller on a mobile phone can be beneficial for borrowers looking to block unwanted calls from Palmcredit. Truecaller allows users to identify and block spam calls, including those from lenders, thereby providing an additional layer of control over communication channels.

By adhering to these guidelines and leveraging Palmcredit's transparent and borrower-centric approach, individuals can effectively manage their financial obligations and maintain a positive relationship with the platform.

-

Tiger credit

Let me give you the lowdown on Tiger Credit

- They'll shoot off SMS to your contacts, saying you owe them money.

- Brace yourself for a barrage of nasty WhatsApp messages if you're just a day late.

- Their repayment plans usually last between 6 to 14 days, making it a real struggle to pay up.

- Expect overdue interest rates of 5% to 7% per day, pushing you deeper into debt.

- Don't bother paying them back once they tarnish your name. They've already got what they wanted.

- Since they're not licensed, they can't take legal action against you. Their only weapon is to smear your reputation.

- Avoid borrowing from other loan apps to settle your debts; you'll only dig yourself into a deeper hole.

- Use Truecaller to screen and block their calls, sparing yourself unnecessary stress.

- The best way to break free from loan sharks is to stop borrowing altogether.

- Block them on WhatsApp and report them directly to WhatsApp and Google Play Store to protect others from falling into the same trap.

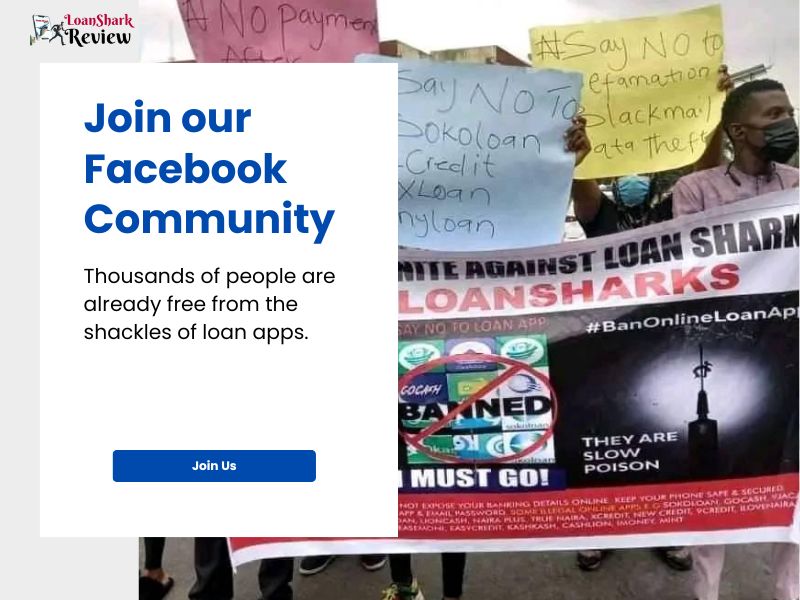

Join our Facebook Group

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.