Expert Review

-

EasyLoan Personal Loan Online

Loan apps may seem like a quick fix for cash shortages, but they often carry significant risks. Here are 10 essential tips to keep in mind when using online loan apps:

Stick to Official Sources for App Downloads Only download loan apps from trusted sources like the Google Play Store. Avoid third-party websites, as they can expose your personal information to misuse, including unauthorized access to your contacts for harassment purposes.

Prepare for Possible Harassment Over Late Payments Even a single late payment could result in a flood of aggressive and hostile messages, particularly via WhatsApp. If this harassment becomes overwhelming, don't hesitate to block the sender to protect your peace of mind.

Beware of Short Repayment Terms Many loan apps have repayment periods of just 6 to 14 days, making it difficult for borrowers to meet deadlines. These short repayment windows can lead to a dangerous cycle of debt.

Watch Out for Sky-High Late Fees Missed payments often trigger daily overdue interest rates of 5% to 7%, which can quickly spiral out of control, making it even harder to get back on track financially.

Damage to Your Reputation Is Their Weapon Loan apps may publicly shame you by sending messages to your contacts if you miss payments, damaging your reputation. Some borrowers even stop repaying after this happens, reasoning that the damage has already been done. You can create a disclaimer to counter any false claims the app might spread.

Avoid Borrowing from Other Apps to Repay Debt Taking out additional loans from other apps to cover existing debts only worsens the problem. This practice can trap you in a never-ending loop of borrowing and repaying.

Use Call-Blocking Apps Like Truecaller Apps like Truecaller can help screen and block harassing calls from loan providers, giving you some relief from constant lender pressure.

Stop Borrowing to Break the Cycle The most effective way to break free from loan app traps is to stop borrowing altogether. It may be difficult, but cutting off access to these high-risk loans is essential to regaining control of your finances.

Block and Report Harassers If you receive threatening or harassing messages, especially on platforms like WhatsApp, block the sender and report them to both WhatsApp and the Google Play Store to help prevent others from falling victim to similar practices.

Consider Avoiding Loan Apps Entirely Many loan apps are designed to trap users in a cycle of debt and misuse personal data. For safer and more secure financial options, it’s often best to avoid these apps completely.

By following these tips, you can protect yourself from the harmful effects of predatory loan apps and maintain better control of your financial health.

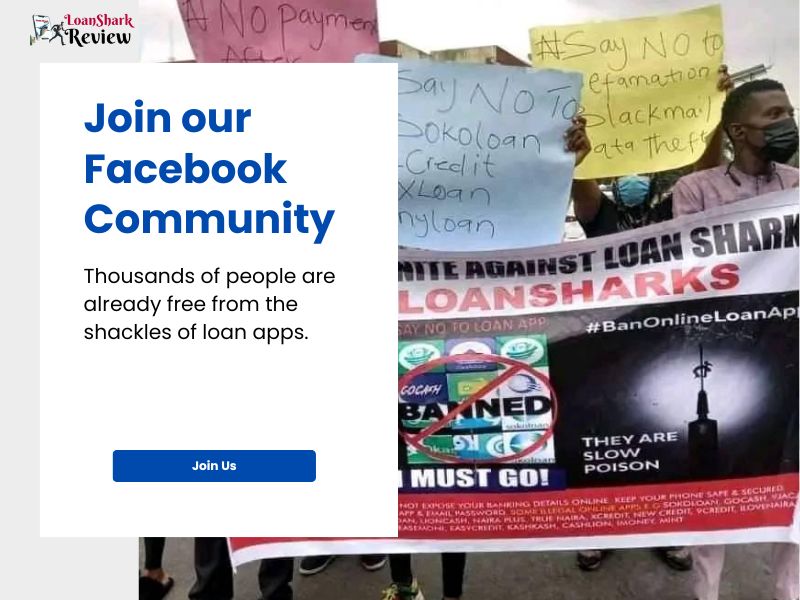

Join our Facebook Group

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.