Expert Review

-

Gogetcredit

1. They will send SMS messages to your contacts, claiming that you owe them money.

2. Prepare yourself for an onslaught of unpleasant WhatsApp messages if you are even a day late.

3. Their repayment schedules typically range from 6 to 14 days, making it extremely challenging to settle your debts.

4. Anticipate daily overdue interest rates ranging from 5% to 7%, pushing you further into debt.

5. Once they tarnish your reputation, there is no need to repay them. They have already achieved their goal.

6. Since they lack a license, they are unable to pursue legal action against you. Their sole tactic is to damage your reputation.

7. Avoid borrowing from other loan apps to clear your debts; this will only worsen your situation.

8. Utilize Truecaller to screen and block their calls, sparing yourself unnecessary stress.

9. The most effective way to break free from loan sharks is to cease borrowing altogether.

10. Block them on WhatsApp and report them directly to WhatsApp and Google Play Store to prevent others from falling victim to the same scheme.

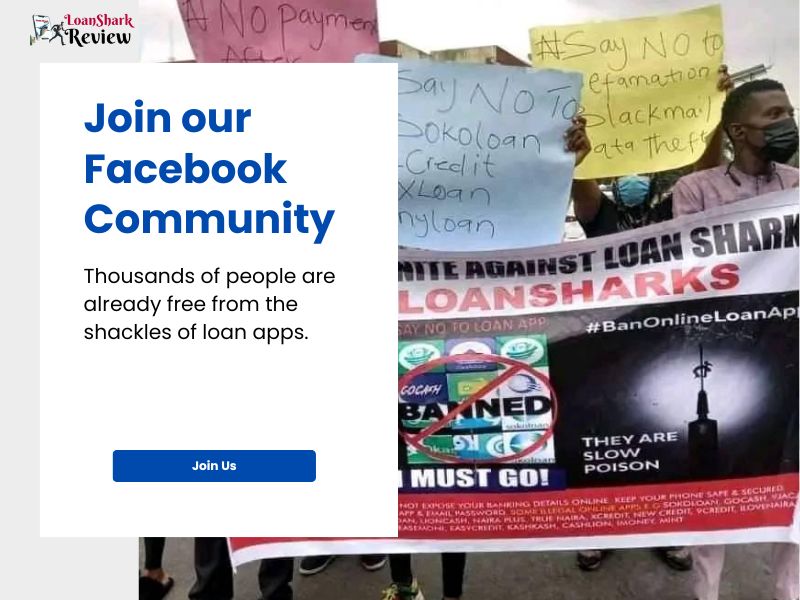

Join our Facebook Group

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.