Expert Review

-

Okash

- Okash is a legit and authorized loan app, so you're in safe hands.

- They won't tarnish your reputation or spread rumors about you.

- If you default on your payments, they'll take the necessary steps and report the matter to the appropriate authorities.

- While their overdue interest rates are fair, you have the option to skip paying them back once you've settled the principal and initial interest.

- Avoid borrowing from other loan apps to settle your debt with Okash. Instead, pay them back when you have the funds available. You can even stretch out your payments over several months, just make sure to honor your commitment.

- Consider installing Truecaller on your phone to identify and block their calls if you'd rather not engage with them.

-

EasyMoni

SMS and Unpleasant Messages:

- So, here’s the deal: when you borrow money from EasyMoni, they might start sending SMS messages to your contacts, telling them that you owe them money. Not cool, right?

- And on WhatsApp, brace yourself! They’ll bombard you with all sorts of not-so-nice messages, starting from just one day overdue. It’s like a digital storm.

Tricky Repayment Plans:

- Now, about paying them back—it’s not a walk in the park. EasyMoni usually gives you a window of 6 to 14 days to repay. But honestly, it feels like climbing Mount Everest without proper gear.

Interest Rates That Sting:

- Hold on tight! Their overdue interest rates range from 2% to a whopping 7% per day. Imagine that—your debt snowballing faster than a rolling boulder.

Defamation Drama:

- Here’s the twist: don’t rush to pay them back just because they’re spreading rumors about you. Nope! They’ve already pocketed their cash by tarnishing your name.

- These loan apps can’t legally chase you down, but they sure know how to sling mud.

No Borrowing from Sibling Apps:

- Listen up: don’t borrow from another loan app to pay off EasyMoni. It’s like trying to put out a fire with gasoline.

- These apps are like a big family—they’re all connected. If you borrow from one, you’ll end up owing them all!

Truecaller to the Rescue:

- Install Truecaller on your phone—it’s like having a superhero caller ID. You’ll know who’s calling, and you can dodge their calls like a ninja.

- Block their numbers and keep your peace of mind intact.

The Ultimate Escape Plan:

- Ready for the magic trick? Stop borrowing altogether. Yep, that’s the secret to breaking free from these loan sharks.

- Block them on WhatsApp and report their shenanigans directly on WhatsApp and Google Play store.

Your Integrity Matters Most:

- Remember, you were doing just fine before these loan apps barged in. Don’t let them mess with your reputation.

- You’ve got this! 🌟

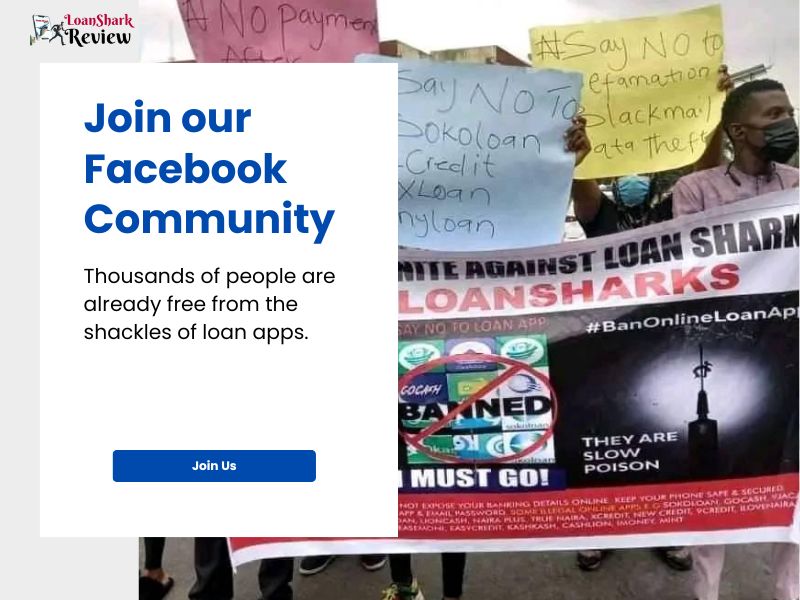

Join our Facebook Group

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.