Expert Review

-

Tloan

Tloan, These guys might seem like a quick fix, but trust me, they can turn into a major headache. Here's the lowdown on why you should steer clear:

1. Shameful Tactics: Forget polite reminders. These apps blast your contacts, painting you as a defaulter even after a day's delay. They might even spam your WhatsApp with nasty messages, tarnishing your reputation in a heartbeat.

2. Crushing Deadlines: They offer loans with super-short repayment periods, like 6-14 days. It's like setting you up to fail, leading to...

3. Debt Spiral: Their insane interest rates (think 2% to 7% per DAY!) trap you in a cycle of debt. Borrowing from another app to pay them off? Bad idea. You'll just end up deeper in their clutches.

4. Empty Threats: Don't let their bullying tactics scare you. These apps often operate outside the law, so their threats are mostly just noise. They can't really do anything to you, except try to shame you.

5. Breaking Free: Here's the key: stop borrowing. It's tough, but it's the only way to escape their grip. Remember, you survived before they came along. You can do it again.

Here's your action plan:

- Install Truecaller: Identify and block their calls.

- Block them on WhatsApp: Cut off communication.

- Report them: Flag them on WhatsApp and the app store.

- Seek help: Talk to trusted friends or family, or consider professional financial advice.

Remember, your dignity and peace of mind are worth more than any quick loan. Don't let these loan sharks drag you down. Take back control and build a brighter future, one step at a time.

-

Frimoni

Protect Yourself When Dealing with Unregistered Loan Apps: A Guide for Frimoni Users

If you're managing loans from unregulated loan providers like IMoney, it's essential to understand certain key aspects of repayment and how to safeguard yourself. Here’s what you need to know when dealing with such platforms:

1. Unregistered Loan Apps

IMoney is not a registered loan app, meaning it does not adhere to the legal guidelines set by Nigerian financial authorities. This lack of regulation can lead to unethical practices, so proceed with caution if you're involved with such services.

2. Dealing with Derogatory Messages to Your Contacts

If IMoney has sent offensive or embarrassing messages to your contacts in an attempt to pressure you into repayment, do not panic. While this tactic is harmful, it’s a strategy used to coerce borrowers. You are not legally obligated to repay under duress. If they persist, calmly inform them that you’re ready to address the matter in court, which often dissuades further harassment.

3. Defamation and Reputational Harm

If your reputation has already been damaged by IMoney through defamatory messages, repaying them will not necessarily undo the harm caused. Once your reputation is affected, the damage is done, and paying them back may not restore it. Focus on protecting yourself from further harassment instead.

4. Install TrueCaller to Block Spam Calls

Install the TrueCaller app on your phone to help identify and block spam calls, including any harassing calls from IMoney. This app provides an extra layer of protection against unwanted contact.

5. Block Auto Debit from Your Bank Account

To prevent IMoney from automatically withdrawing money from your bank account, it’s essential to block your bank card. Visit your bank and request a new card to ensure they can't access your funds through auto-debit.

6. Block and Report on WhatsApp

If IMoney contacts you via WhatsApp, block their number to stop receiving their messages. Additionally, report their number to WhatsApp to alert the platform about their behavior, which may lead to their account being flagged or suspended.

7. Report the App to Google Play or iOS App Store

If IMoney is listed on the Google Play Store or iOS App Store, report the app to the platform. This not only helps alert other users to their unethical practices but may also result in the removal of the app from these stores, protecting future borrowers.

Take Action to Protect Yourself

By following these steps, you can safeguard yourself from further harassment and protect your finances. Whether it's blocking calls, reporting the app, or preventing unauthorized withdrawals, you have control over how to respond to unethical loan providers like IMoney.

Remember, Frimoni provides a safe and transparent loan process, so you can avoid these pitfalls with our reliable service. Always choose trusted, registered loan apps to protect your peace of mind.

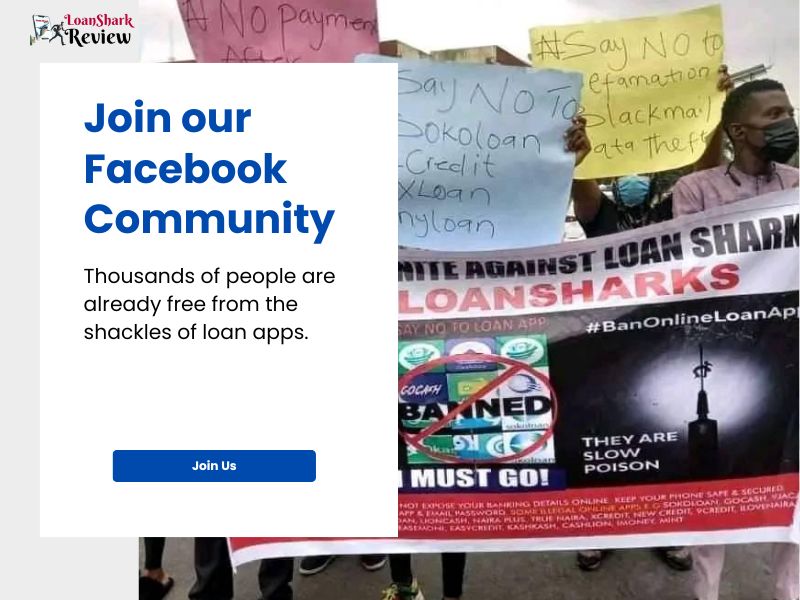

Join our Facebook Group

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.