| Interest Rate | 30% |

| Duration | 14 |

| Access Level | Public |

| Company Name | CreditClan Tech Limited |

| Phone 1 | |

| Phone 2 | |

| Website or Store | |

| Address | |

| Category | Mild Loan |

| Company Email | |

| Views | 529 |

Clan App

Meet CLAN APP, a trailblazing fintech company revolutionizing the lending landscape in Nigeria and Ghana. Known for its streamlined approach to loans, CLAN APP makes borrowing straightforward and accessible. Approved by the Central Bank of Nigeria (CBN), CLAN APP stands as a trusted partner for those seeking financial support.

What sets CLAN APP apart is its no-collateral policy, which means you can secure a loan without pledging valuable assets like a house or car. With loan amounts reaching up to N1,000,000, CLAN APP caters to a wide range of financial needs, from personal emergencies to business investments.

Founded and operated by a Ghanaian entrepreneur, CLAN APP brings a unique perspective to the African financial market. Its success in Ghana and growing reputation across the continent highlight its commitment to providing accessible financial solutions.

History and Overview

Launched in 2019 by CREDITCLAN TECH LIMITED, CLAN APP quickly established itself as a key player in the fintech sector. Initially, the company introduced a pay-later service, offering users the flexibility to make purchases and pay at their convenience—a feature that resonated well with those needing financial flexibility.

However, CLAN APP faced a significant challenge when the Central Bank of Nigeria (CBN) delisted and revoked its license. This setback stemmed from regulatory issues, which put the company’s operations on hold. Despite these hurdles, CLAN APP remained steadfast in improving its services and addressing the concerns raised by the regulatory authorities.

The company’s perseverance paid off this year when it received renewed approval from the CBN. This comeback underscores CLAN APP’s resilience and commitment to adhering to regulatory standards. Now back in business, CLAN APP continues to offer its pay-later services and other financial solutions, proving its adaptability and dedication to the Nigerian market.

Loan Requirements

To access CLAN APP’s loan services, applicants must meet specific criteria:

Nigerian Citizenship

As CLAN APP operates within Nigeria’s legal framework, it requires applicants to be Nigerian citizens. This requirement ensures compliance with local regulations and helps maintain transparency in operations. Being a Nigerian also aligns with CLAN APP’s commitment to serving its domestic market.

Business Ownership

CLAN APP mandates that applicants have a business valued at a minimum of N10 million. This requirement is designed to ensure that loans are provided to individuals with established, substantial business operations. By lending to well-established businesses, CLAN APP mitigates the risk associated with loan issuance.

Active Customer Status

To qualify for a loan, applicants must have been active customers for at least a year. This stipulation reflects CLAN APP’s focus on nurturing long-term relationships with its users. A history of engagement allows CLAN APP to assess an applicant’s reliability and creditworthiness more effectively. By evaluating financial behavior and repayment habits over time, CLAN APP can make more informed lending decisions.

Expert Counsel

Meet CLAN APP, a trailblazing fintech company revolutionizing the lending landscape in Nigeria and Ghana. Known for its streamlined approach to loans, CLAN APP makes borrowing straightforward and accessible. Approved by the Central Bank of Nigeria (CBN), CLAN APP stands as a trusted partner for those seeking financial support.

What sets CLAN APP apart is its no-collateral policy, which means you can secure a loan without pledging valuable assets like a house or car. With loan amounts reaching up to N1,000,000, CLAN APP caters to a wide range of financial needs, from personal emergencies to business investments.

Founded and operated by a Ghanaian entrepreneur, CLAN APP brings a unique perspective to the African financial market. Its success in Ghana and growing reputation across the continent highlight its commitment to providing accessible financial solutions.

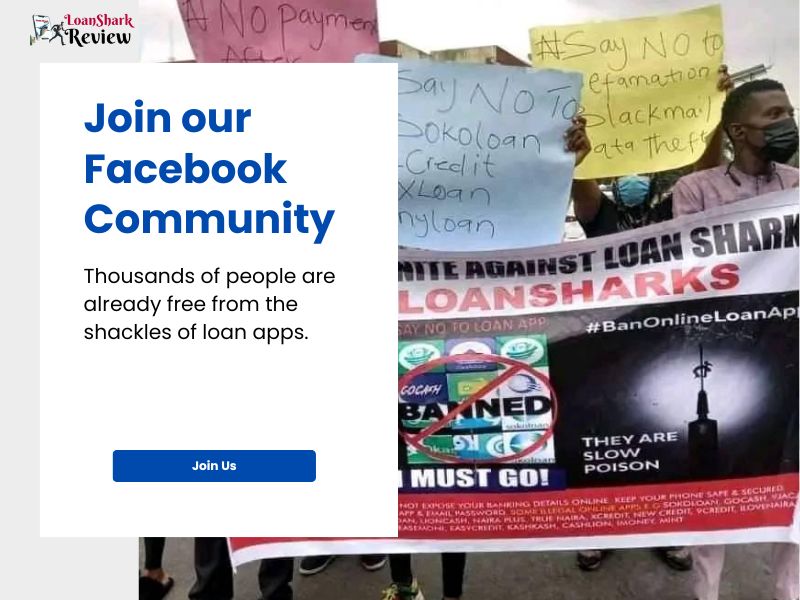

Join our Facebook Group

Reviews

Related Loans

Safely Report A Loan Shark

If you have borrowed from a loan shark or are worried about someone else, we’re here to help and keep you safe. Learn how to break free from their grasp.