| Interest Rate | 45% |

| Duration | From 7 days |

| Access Level | Public |

| Company Name | Viduse loan app |

| Phone 1 | 09035171485 |

| Phone 2 | |

| Website or Store | they also chatted me on WhatsApp as well and as i speak now they spreading my pictures everywhere tagging me as a fraudster and kidnapper and a rapist right now now i have all the pictures with me as an evidence |

| Address | |

| Category | Mild Loan |

| Company Email | |

| Views | 1,116 |

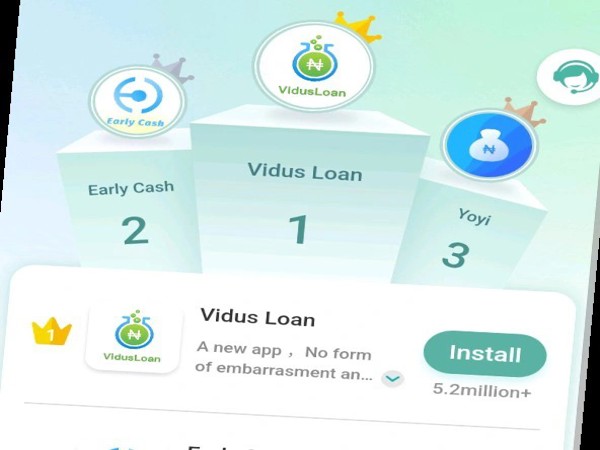

Viduse loan app

Training Videos

Frequently Asked Questions

Let's have an honest discussion about the Viduse loan app and what you should be aware of to safeguard yourself on your borrowing journey.

First and foremost, Viduse is known for being aggressive with debt collection tactics. If you miss a payment, even by a single day, they have been known to send SMS messages to your contacts, informing them about your outstanding debt. Additionally, Viduse may flood your WhatsApp inbox with unpleasant, sometimes defamatory messages if you're overdue. It’s an uncomfortable experience, so being on time with payments is key.

Now, let's discuss their interest rates. Be prepared, as they can be steep, especially for overdue loans. Viduse charges interest ranging from 5% to 7% per day on late payments. This can quickly add up, making your debt grow faster than you might expect. If you're not cautious, the debt can snowball, leaving you in a difficult financial situation.

One essential piece of advice is that if Viduse resorts to defaming you, it may not be worth continuing to repay them. Once they've taken this route, the damage is done, and paying them back won't reverse the harm to your reputation. Additionally, Viduse isn't licensed, meaning they lack the legal authority to pursue you beyond tarnishing your name. Their primary tool is public shaming rather than lawful enforcement.

Whatever you do, avoid the temptation to take out a loan from another app to settle your Viduse debt. Viduse may operate multiple lending apps, and using one to pay off another will only deepen your financial troubles. It's a vicious cycle, and you'll find yourself sinking further into debt.

To protect yourself from Viduse's harassment, consider installing Truecaller on your phone. This handy app will help you identify and block their calls, allowing you some breathing room and peace of mind.

The best way to break free from Viduse's grip is to stop borrowing from them altogether. It may be challenging, but it's the only surefire way to avoid getting entangled in their debt trap.

Ultimately, your financial health is more valuable than any loan. Stay vigilant, make informed borrowing decisions, and don’t let Viduse or any other predatory lender drag you down.

Take care, and here’s to a debt-free future!

.webp)