Ade was a hardworking mechanic in Lagos who had a dream of expanding his small workshop into a full-service garage. He saved diligently, but with the rising cost of tools and equipment, he found that his savings were not enough to take his business to the next level. One day, a man approached him offering a quick loan with no collateral or paperwork. The terms seemed too good to be true, but Ade was desperate, so he agreed.

Within weeks, the interest rates spiraled out of control, and Ade could no longer keep up with the payments. The man who loaned him the money began showing up at his shop, threatening him and damaging his reputation in the neighborhood. Ade realized he had fallen into the trap of a loan shark.

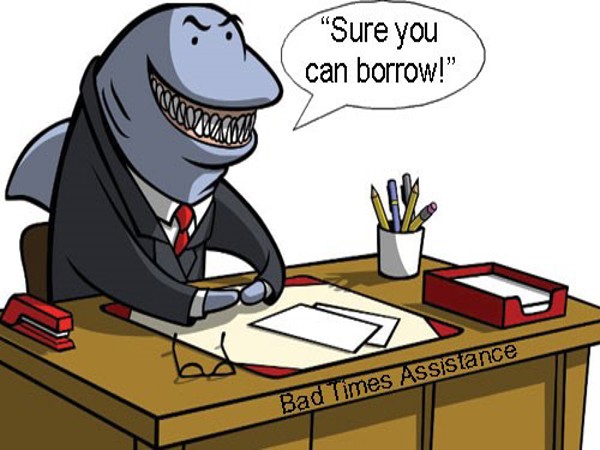

This experience made Ade reflect on the unethical nature of loan sharks and how they prey on vulnerable individuals. Loan sharks have no place in business because their predatory practices harm individuals, communities, and the economy at large.

What are Loan Sharks?

Loan sharks are illegal money lenders who offer loans at outrageously high-interest rates without any proper documentation or regulation. They often target people who are in financial distress, offering loans that seem easy to access but come with devastating consequences. Loan sharks are known for using threats, intimidation, and even violence to force borrowers into paying back their loans.

Why Loan Sharks Have No Place in Business

The practices of loan sharks are not only illegal but also deeply unethical. They exploit the financial desperation of individuals and small business owners, trapping them in cycles of debt that are nearly impossible to escape. Here are the reasons why loan sharks should have no place in any business environment:

Exorbitant Interest Rates

Loan sharks charge interest rates that are astronomically higher than what legitimate lenders offer. These rates often compound rapidly, making it impossible for borrowers to repay. For example, while a legitimate microfinance bank may charge 10-30% interest annually, a loan shark could charge 50% or more in a matter of weeks. This unfair practice takes advantage of people who have limited financial literacy and no access to formal credit systems.

Lack of Transparency

Unlike legitimate lenders, loan sharks do not provide clear terms and conditions. They rarely give borrowers a contract or any formal agreement outlining the loan amount, interest rate, and repayment terms. This lack of transparency makes it easier for loan sharks to manipulate borrowers and change the terms at will.

Aggressive Collection Practices

Loan sharks use unethical and often illegal methods to recover their money. Harassment, public shaming, threats, and even physical violence are common tactics. Legitimate lenders, on the other hand, follow legal debt recovery processes and respect the dignity of borrowers.

No Consumer Protection

Borrowers who fall victim to loan sharks have no legal recourse because these lenders operate outside the law. Legitimate financial institutions are regulated by government bodies and must follow rules designed to protect consumers. For example, in Nigeria, the Central Bank of Nigeria (CBN) oversees lending practices to ensure fairness.

Damage to Local Communities

Loan sharks do more than just harm individual borrowers; they also negatively impact entire communities. Businesses that rely on loan sharks often fail because they cannot manage the high-interest payments. When small businesses collapse, local economies suffer, and the ripple effect is felt by families and neighbors.

A Step-by-Step Guide to Ethical Borrowing

To avoid falling into the clutches of loan sharks, individuals and business owners must be aware of ethical borrowing practices. Here’s a step-by-step guide to securing a legitimate loan:

Research the Lender Before accepting any loan, it’s essential to research the lender’s background. Ensure that the lender is registered with regulatory bodies like the Central Bank of Nigeria (CBN) or other financial authorities. This ensures that the lender follows legal and ethical lending practices.

Compare Interest Rates Don’t rush into borrowing. Take time to compare the interest rates of different lenders, including commercial banks, microfinance banks, and licensed online lenders. A legitimate lender will offer fair rates and provide full transparency on how the interest is calculated.

Review the Terms and Conditions Always ask for a written contract that outlines the loan amount, interest rate, repayment schedule, and any additional fees. Make sure you fully understand the terms before signing. Legitimate lenders will be happy to explain any part of the agreement that is unclear.

Avoid Quick Loan Offers Be cautious of any lender who offers you a loan without proper documentation or checks. Legitimate lenders typically ask for some form of collateral, credit check, or documentation to assess your ability to repay the loan. If a lender is offering money with no questions asked, it’s a red flag.

Keep Detailed Records Always keep records of your loan agreements, payments, and correspondence with the lender. These records can protect you if any disputes arise in the future. In the case of a legitimate loan, these documents also help ensure that the lender cannot alter the terms after the fact.

Seek Legal Help if Harassed If you have borrowed from a loan shark and are being harassed, report them to the authorities. In Nigeria, the FCCPC (Federal Competition and Consumer Protection Commission) deals with consumer protection, and borrowers can lodge complaints against lenders who engage in unlawful practices.

Look for Alternative Financing Options If you are struggling to get a loan from a traditional bank, explore other ethical options. Microfinance institutions, cooperative societies, and government-backed schemes offer affordable loans to small business owners and individuals without resorting to unethical practices.

The Role of Ethical Lending in Building Sustainable Businesses

Ethical lending is vital for building sustainable businesses and promoting economic growth. Legitimate lenders play a critical role in supporting entrepreneurship and providing individuals with the financial resources they need to improve their lives. When loans are given fairly and transparently, borrowers are more likely to succeed and contribute positively to the economy.

Loan sharks, on the other hand, destroy this potential by creating a culture of fear, debt, and dependency. Ethical lending builds trust between lenders and borrowers, while predatory lending tears that trust apart.

Conclusion

Ade’s story serves as a powerful reminder of the dangers of loan sharks. These illegal lenders prey on those who are most vulnerable, trapping them in cycles of debt and despair. In contrast, legitimate lenders provide a pathway to financial stability and success through fair and ethical practices.

Understanding the difference between loan sharks and ethical lenders is crucial for protecting your business and your financial future. If you or someone you know is considering borrowing money, take the time to research your options and choose a lender who operates with integrity. By doing so, you can avoid the hidden costs and emotional toll of predatory lending and set yourself up for long-term success.

.jpg)