I came across this website and one a Facebook Group Say No to Sokoloan hence my redemption. I stop paying all the loan apps like Tikcredit, Cashlawn, Mintbag , Camelloan and Cashmall because they defamed me. Their money is gone to glory.

Chaii this website and Say no to Sokoloan Facebook group is God sent to me

Many people have experienced the frustration of needing quick cash and turning to loan apps only to find themselves stuck in a cycle of debt. It can be tempting to borrow from these apps, especially when faced with unexpected expenses or emergencies. However, the high-interest rates and aggressive debt collection tactics used by some loan apps can quickly turn a small loan into an overwhelming debt burden.

I remember the day my loan on NowNow loan Apps money was due in the evening of that same day and my oga that is suppose dash me money disappointed me, I didn’t know who to call to give me 20,000 Naira urgently and were also let down by a friend who was supposed to lend them the money. I turned to loan apps but could only raise 18,000 Naira, leaving them short of their target amount. Eventually, I had to borrow from a customer who runs a rice stall, leading to a difficult and uncomfortable situation.

I believe strongly that once you start borrow you may be inviting a "demonic spirit" behind loan apps, leading people to become trapped in debt. While this may be an exaggeration, it is true that loan apps can be dangerous for those who are not careful. Many of these apps use aggressive tactics to collect debt, including harassment and threats of violence. Borrowers who are unable to repay their loans on time can find themselves facing exorbitant fees and interest rates, making it even more difficult to pay off their debts. Before you realize it you may be owing 20 to 30 loan apps

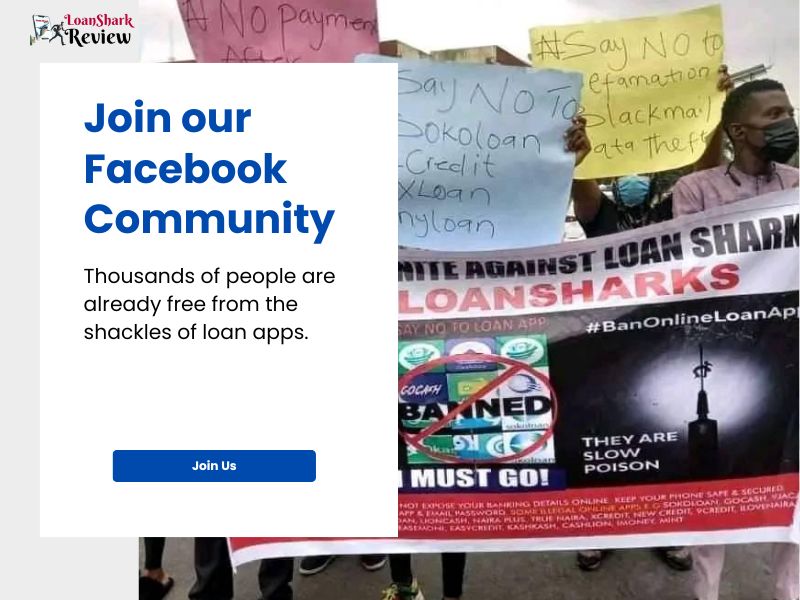

Fortunately, I came across this website and one a Facebook Group Say No to Sokoloan hence my redemption. I stop paying all the loan apps like Tikcredit, Cashlawn, Mintbag , Camelloan and Cashmall because they defamed me. Their money is gone to glory. It is important to stop borrowing from these apps immediately and evaluate your financial situation. Make a list of all your debts and prioritize them based on interest rates and amounts owed.

My Advice for reader

It is also important to take care of your mental health, as financial stress can take a toll on your wellbeing. Seeking support from family and friends, setting financial goals, and educating yourself about personal finance can also be helpful. Breaking free from the cycle of debt caused by loan apps takes time and effort, but it is possible with persistence and dedication.

In conclusion, loan apps can be a dangerous trap for those who are not careful. Borrowers can find themselves facing exorbitant fees and interest rates, making it difficult to pay off their debts. However, there are steps that individuals can take to break free from this cycle of debt, including creating a budget, negotiating with creditors, and seeking help from debt relief programs or financial assistance programs. Taking care of your mental health and seeking support from loved ones can also be helpful in achieving financial freedom. With persistence and dedication, it is possible to break free from the cycle of debt caused by loan apps.