Through the collective strength of the group, Adebayo has managed to break free from the clutches of loan sharks, finding resilience and courage amidst the adversity she faced.

Unemployment and inflation have created a dire situation in Nigeria, pushing many desperate individuals into the clutches of unscrupulous loan companies. One such individual is Adebayo, a 28-year-old unemployed medical physiology graduate. She has been subjected to a barrage of abusive WhatsApp messages and voice notes from debt collectors representing quick loan companies. The messages she received were filled with threats, defamation, and attempts to shame her, causing immense distress and even driving her to contemplate suicide.

Adebayo's story is not unique. The country's largest economy has experienced a significant rise in unemployment, inflation, and the overall cost of living, which has contributed to the rapid growth of the quick loan industry. Advertisements for quick loans can be seen at bus stops, street corners, and heard on the radio. The distressing messages sent to Adebayo's contacts have gained widespread attention on social media, shedding light on the harassment and public shaming tactics employed by these loan companies against people struggling with debt.

Adebayo had initially relied on small loans of 40,000 naira (£70) from a loan company based in Lagos to cover her expenses until her next payday. However, after losing her job in October, her debts began to pile up rapidly. In desperation, she downloaded multiple quick loan applications, accumulating more debts to repay existing ones. As she fell behind on her payments, the reminders quickly transformed into sinister threats, not only directed at her but also sent to her family, friends, and everyone in her contacts. These companies exploited the personal information provided during the loan application process to target and manipulate Adebayo through her social connections.

Calls for government intervention have grown louder, with accusations that many of these loan companies operate without proper registration and enforce illegal conditions. Former employees have revealed that some companies pay below the minimum wage and incentivize abusive behavior among debt collectors. Sophie Olubode, a former debt collector, shared her experience working in a toxic environment where extreme measures were encouraged. She recounted an incident where a colleague deceived a girl's father into believing that his daughter was in police custody until the debt was paid.

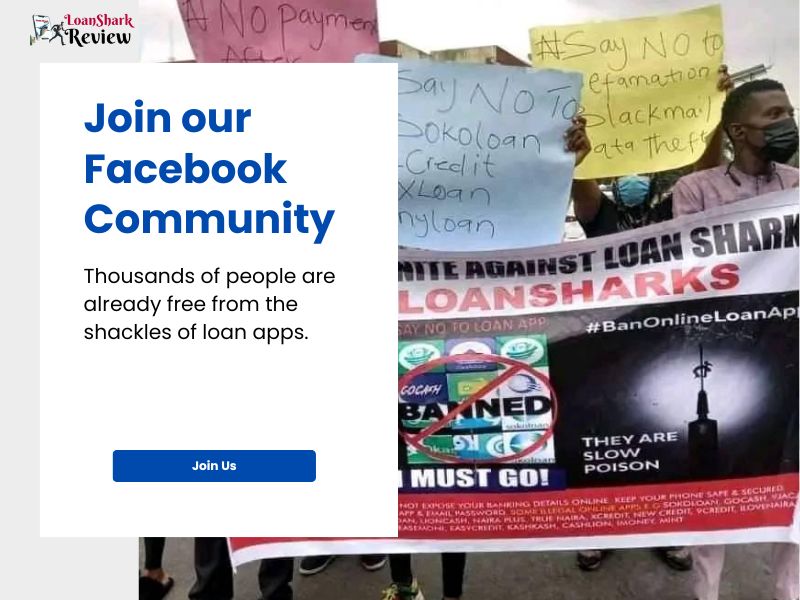

Typically, individuals seek these loans for minimal amounts, such as covering basic necessities like food, transportation, or medical expenses. However, the application process traps them in a cycle of debt, with outstanding amounts quickly escalating to unmanageable sums. Despite facing immense challenges, Adebayo found solace and support in a Facebook group comprising over 19,000 members who have encountered similar experiences. Within this community, stories of abuse and harassment are shared, providing a platform for empathy and empowerment. Members encourage each other to repay their debts while refusing to succumb to the threats. They debunk fabricated documents claiming police involvement and respond to threats with humor and defiance.

The Facebook group was founded by Willis Osunde, a 32-year-old unemployed economics graduate, who himself faced ongoing difficulties with fast loan companies. Through the collective strength of the group, Adebayo has managed to break free from the clutches of loan sharks, finding resilience and courage amidst the adversity she faced.

Adebayo's journey highlights the urgent need for stricter regulations and oversight of the quick loan industry in Nigeria. The stories of those affected serve as a call to action, urging authorities to protect vulnerable individuals from harassment, exploitation, and the devastating consequences of unmanageable debt.